As someone who has been practicing credit card churning for a while, I have learned a lot about how to do it effectively and efficiently.

Understanding the basics of credit card churning is crucial before diving into the strategy. It involves finding the right credit cards that offer attractive sign-up bonuses, meeting the minimum spending requirements to earn those bonuses, and then closing the accounts before the annual fees kick in.

Choosing the right credit cards and managing multiple accounts can be overwhelming, but with the right approach, it can be a lucrative and rewarding experience. In this article, I will share my personal experience and tips on how to do credit card churning successfully.

I must confess, there was a phase in my life when I became quite the credit card churner. I’d discovered this intricate world of sign-up bonuses, reward points, and travel perks, and the thrill of optimizing each new card was too enticing to resist.

The concept was simple: sign up for a card, meet the minimum spending requirement, earn the bonus, and then move on to the next offer.

I meticulously researched the best credit card offers available, comparing their sizes, details, and specs with the precision of an accountant during tax season. I looked for cards that offered large sign-up bonuses, preferably with points that could be transferred to various airline and hotel loyalty programs. I paid close attention to the fine print, noting the exact spending requirements, the time frame for meeting them, and any annual fees that might apply.

My first foray into churning was with a card that promised a generous 50,000-point bonus after spending $3,000 in the first three months. The card itself was a sleek piece of plastic, standard wallet size, with a shiny embossed logo that seemed to wink at me with the promise of adventure. I hit the spending requirement by funneling all my usual expenses through the card, from groceries to utility bills.

When the points hit my account, it was like watching a high-score tick over on a video game – exhilarating. I was hooked. I quickly moved on to the next card, and the next, always careful to keep track of my applications and spending in a detailed spreadsheet. I never carried a balance, always paying off my bills in full to avoid interest. The last thing I wanted was for my clever scheme to backfire and land me in debt.

Over time, I amassed a trove of points and miles. I flew to Paris in business class, a luxury I never thought I’d experience, with a lie-flat seat that transformed the long-haul flight into a delight. I stayed in five-star hotels in Tokyo, where the size of the room was modest, but the amenities were top-notch. And I did it all on a budget that would have otherwise limited me to far less extravagant travels.

But churning wasn’t without its challenges. Keeping up with multiple accounts required a level of organization and discipline that sometimes felt like a second job.

Choosing the Right Credit Cards

When it comes to credit card churning, choosing the right credit cards is crucial. Here are some factors I consider when selecting a credit card:

Rewards and Bonuses

The rewards and bonuses offered by a credit card are the primary reason for churning it. I look for cards that offer high rewards points or cash back for spending a certain amount within a specified time frame. Some cards also offer sign-up bonuses that can be worth hundreds of dollars.

I also consider the rewards categories offered by the card. For example, if I travel frequently, I look for cards that offer travel rewards. If I spend a lot on groceries or gas, I look for cards that offer cash back in those categories.

Annual Fees and Interest Rates

Annual fees and interest rates can significantly impact the overall value of a credit card. I prefer cards with no annual fees or low fees that are offset by the rewards and bonuses offered.

I also pay close attention to interest rates, as carrying a balance can quickly negate any rewards earned. I only use credit cards for purchases I can pay off in full each month to avoid interest charges.

Understanding Credit Card Churning

Basics of Credit Card Churning

Credit card churning is the practice of opening and closing credit cards in order to earn sign-up bonuses and rewards points. The goal is to maximize the rewards earned while minimizing the fees and interest paid. This strategy is popular among frequent travelers and those looking to earn cashback or other rewards.

To successfully churn credit cards, one must have good credit and be able to pay off their balances in full each month. It’s important to keep track of the opening and closing dates of each card to avoid any negative impact on credit scores.

Risks and Rewards

The rewards of credit card churning can be significant, including free flights, hotel stays, cashback, and other perks. However, there are also risks involved. One risk is overspending in order to meet the minimum spending requirements for the sign-up bonus. This can lead to debt and high-interest charges.

Another risk is the impact on credit scores. Opening and closing multiple credit cards can lead to a decrease in credit score due to the hard inquiries and reduced average age of credit accounts. It’s important to weigh the potential rewards against the risks before deciding to pursue a credit card churning strategy.

Planning Your Churning Strategy

When it comes to credit card churning, planning is key. Without a solid strategy, you could end up with a bunch of credit cards that don’t offer the rewards you’re looking for or that have high annual fees that cancel out any benefits. Here are some things to consider when planning your churning strategy.

Choosing the Right Credit Cards

The first step in planning your churning strategy is to choose the right credit cards. Look for cards that offer sign-up bonuses and rewards that align with your spending habits and goals. Consider the annual fees and whether the rewards outweigh the costs. It’s also important to note the card issuer’s rules around churning, as some may limit the number of times you can receive a sign-up bonus or require a waiting period between applications.

To help you choose the right cards, consider using a spreadsheet or table to compare the benefits and costs of each card side by side. Look for cards that offer the most value for your spending habits and goals.

Timing Your Applications

Timing is also important when it comes to credit card churning. Applying for multiple cards at once can hurt your credit score, so it’s important to space out your applications. Consider applying for one or two cards at a time and waiting a few months between applications.

You should also be mindful of the timing of sign-up bonuses. Some cards require you to spend a certain amount within a certain timeframe to receive the bonus, so plan your applications accordingly. You don’t want to miss out on a sign-up bonus because you applied too early or too late.

Implementing Your Strategy

Once you have selected your credit cards and determined your churning strategy, it’s time to implement it. This section will cover two key aspects of implementing your strategy: meeting minimum spending requirements and managing multiple credit cards.

Meeting Minimum Spending Requirements

Meeting minimum spending requirements is critical to earning the sign-up bonuses that are the cornerstone of credit card churning. To meet these requirements, cardholders must spend a certain amount of money on their credit card within a set timeframe, usually 90 days.

There are several ways to meet minimum spending requirements, including:

- Paying bills: Use your credit card to pay bills such as rent, utilities, and insurance premiums.

- Making large purchases: If you have a large purchase coming up, consider using your credit card to meet the minimum spending requirement.

- Prepaying expenses: Prepaying expenses such as car insurance or a gym membership can help you meet the minimum spending requirement.

- Purchasing gift cards: Buying gift cards for stores or restaurants you frequent can help you meet the minimum spending requirement.

Managing Multiple Credit Cards

Managing multiple credit cards can be challenging, but it’s necessary for successful credit card churning. Here are some tips for managing multiple credit cards:

- Keep track of due dates: Make sure you know when each credit card payment is due and pay on time to avoid late fees and interest charges.

- Set up automatic payments: Consider setting up automatic payments to ensure you never miss a payment.

- Monitor your credit score: Keeping an eye on your credit score can help you identify any issues and make sure you are on track to meet your goals.

- Keep track of rewards: Keep a spreadsheet or use an app to track your rewards and make sure you are maximizing your earnings.

- Consider a balance transfer: If you are struggling to manage multiple credit cards, consider a balance transfer to consolidate your debt and simplify your payments.

By following these tips, you can successfully implement your credit card churning strategy and maximize your rewards.

Advanced Churning Techniques

Leveraging Bonus Categories

One of the most effective ways to maximize credit card rewards is to take advantage of bonus categories. Many credit cards offer bonus points or cashback for specific types of purchases, such as dining, travel, groceries, or gas. Savvy churners can strategically use their credit cards to earn the most rewards possible by using the right card for each purchase.

For example, if someone frequently dines out, they may want to use a credit card that offers bonus points for dining purchases. If they drive a lot, they may want to use a card that offers bonus points for gas purchases. By using the right card for each purchase, they can earn significantly more rewards than if they used a single card for everything.

Taking Advantage of Promotional Offers

Another advanced churning technique is to take advantage of promotional offers. Credit card issuers often offer sign-up bonuses, spending bonuses, or other promotions to encourage people to apply for their credit cards or use them more frequently.

For example, a credit card may offer a sign-up bonus of 50,000 points after spending $3,000 in the first three months of card membership. Or, they may offer a spending bonus of 10,000 points for spending $1,000 in a specific category within a certain time frame. By taking advantage of these promotions, churners can earn a significant amount of rewards in a short amount of time.

However, it’s important to be aware of the terms and conditions of these promotions. Some may have high spending requirements, annual fees, or other restrictions that may not be worth it for the churner.

Advanced Churning Strategies

As I’ve gained more experience with credit card churning, I’ve developed some advanced strategies to maximize my rewards. Here are two of my favorites:

Manufactured Spending

Manufactured spending is a technique that involves using credit cards to purchase items that can be easily converted to cash, such as gift cards or money orders. By doing this, you can meet the minimum spending requirements for new credit card bonuses without actually spending the money on things you don’t need.

One popular way to manufacture spending is to buy Visa or Mastercard gift cards at a grocery store or drugstore with a credit card that earns bonus points for those purchases. Then, you can use the gift cards to pay bills or buy money orders, which can be deposited into your bank account.

Multiple Card Applications

Another strategy I use is applying for multiple credit cards at once. This can be risky if you’re not careful, as too many inquiries on your credit report can hurt your credit score. However, if you time it right and choose the right cards, you can earn a lot of rewards quickly.

To do this, I research which credit card issuers use the same credit bureau for inquiries and apply for multiple cards from those issuers on the same day. This way, the inquiries are combined into one and have less of an impact on my credit score.

Maintaining Your Credit Score

Maintaining a good credit score is crucial when implementing a credit card churning strategy. A good credit score not only helps you qualify for better credit cards with higher rewards, but it also helps you secure better interest rates on loans and mortgages. In this section, we’ll cover a few key ways to maintain your credit score while using a credit card churning strategy.

Monitoring Your Credit Report

Monitoring your credit report is essential to maintaining a good credit score. You should regularly check your credit report for any errors or fraudulent activity that could negatively impact your credit score. You can obtain a free copy of your credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

Balancing Applications

When applying for new credit cards, it’s important to balance your applications. Applying for too many credit cards within a short period of time can negatively impact your credit score. It’s recommended that you space out your credit card applications by at least three months.

Credit Utilization

Credit utilization is another important factor that affects your credit score. Credit utilization is the amount of credit you’re currently using compared to your total credit limit. A high credit utilization ratio can negatively impact your credit score. It’s recommended that you keep your credit utilization ratio below 30%.

Frequently Asked Questions

What are some effective credit card churning techniques?

Some effective credit card churning techniques include signing up for credit cards with high sign-up bonuses, meeting the minimum spending requirements, and canceling the credit card before the annual fee is due. Another technique is to space out credit card applications to avoid triggering red flags with the credit card issuer.

How many credit cards should I have for churning?

The number of credit cards you should have for churning depends on your personal financial situation and credit score. Generally, it is recommended to have no more than 5 credit cards open at a time. It is important to keep track of when annual fees are due and to cancel credit cards that are no longer useful.

What is the best strategy for credit card churning?

The best strategy for credit card churning is to have a plan and stay organized. Research credit cards with high sign-up bonuses and determine which ones fit your spending habits. Keep track of when minimum spending requirements need to be met and when annual fees are due. Cancel credit cards that are no longer useful and keep your credit score in good standing.

Which credit card is best for churning?

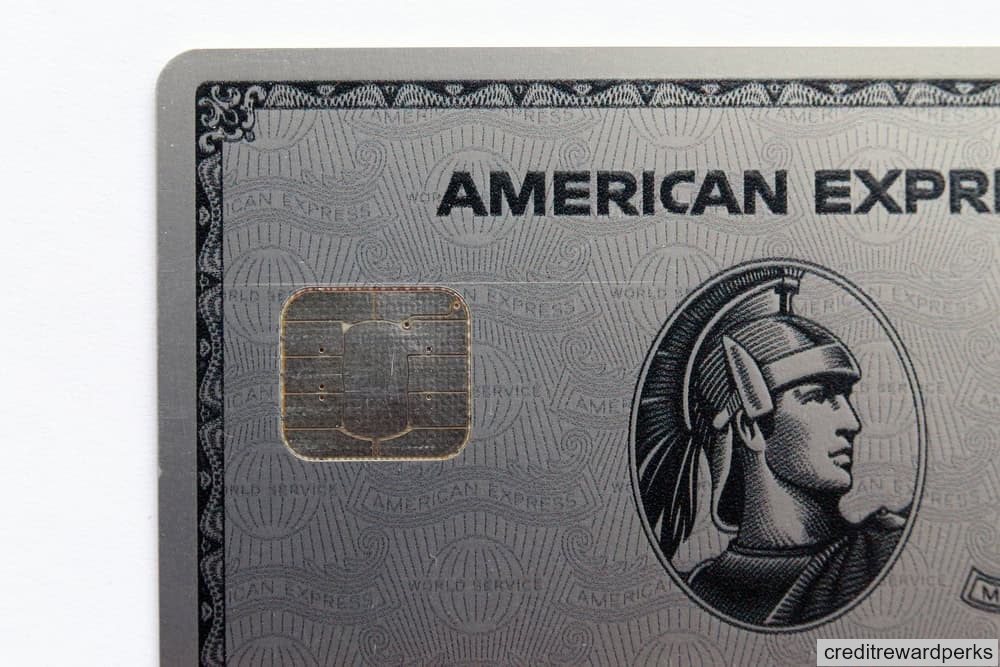

The best credit card for churning depends on your personal spending habits and financial situation. Look for credit cards with high sign-up bonuses and rewards programs that fit your lifestyle. Some popular options include the Chase Sapphire Preferred, American Express Platinum, and Capital One Venture.

Can credit card churning be profitable?

Credit card churning can be profitable if done correctly. By earning sign-up bonuses and rewards points, you can save money on travel, earn cashback, and receive other benefits. However, it is important to keep track of annual fees and to avoid carrying a balance on your credit cards, as interest charges can quickly negate any rewards earned.

Is credit card churning legal?

Credit card churning is legal, but it is important to read the terms and conditions of each credit card offer to ensure that you are not violating any rules. Some credit card issuers may have restrictions on how often you can apply for their credit cards or may limit the number of sign-up bonuses you can receive. It is important to follow the rules and guidelines set by the credit card issuer.