You will get cash back, gift card, LoungeKey access, and travel insurance.

Sign-up bonus

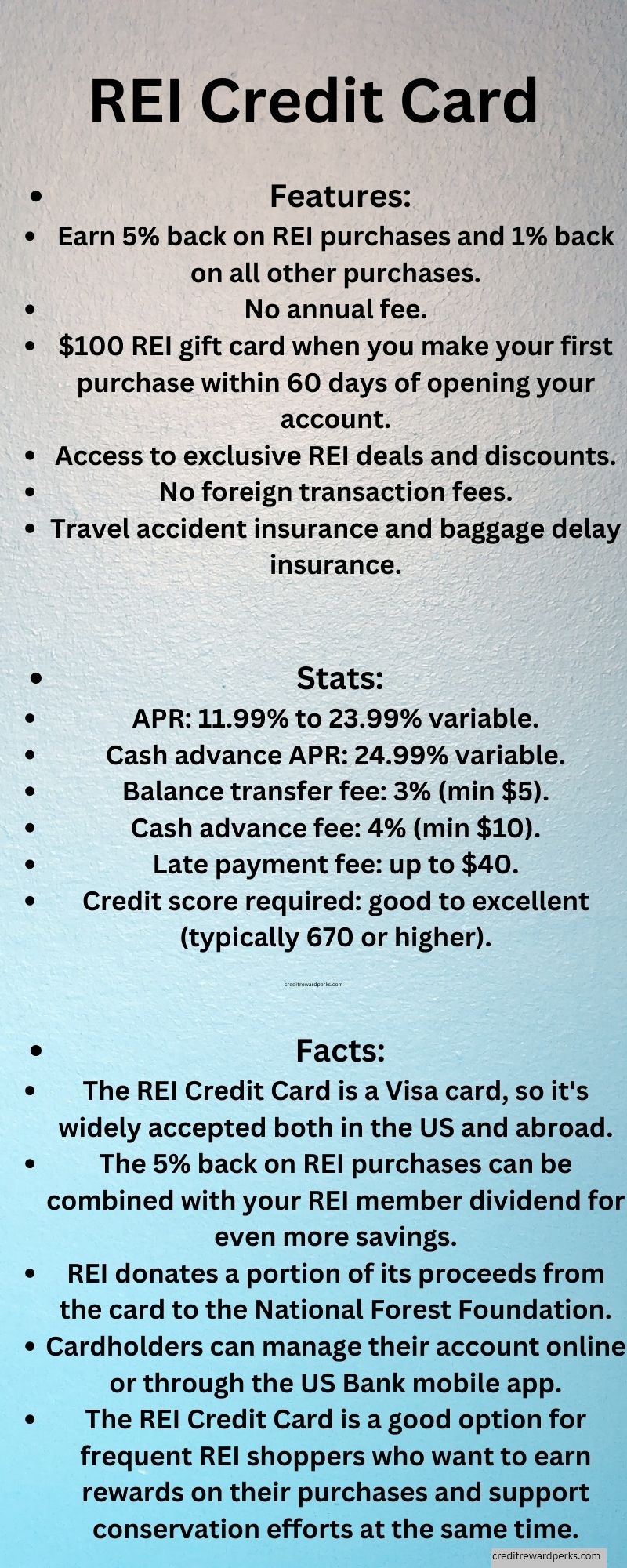

he REI credit card is a solid cash-back card that lets me earn a percentage of each purchase back in cash. Now, I gotta be honest—there’s no cash sign-up bonus or loyalty bonus, so if I’m not spendin’ a good chunk, it might not be the best fit. But if I’m plannin’ to use the card for my REI purchases, it can definitely come in handy!

For new cardholders, the REI Co-op Mastercard has a sweet deal where I can snag a $100 gift card. There’s no minimum purchase amount, which is nice, and I’ll get that gift card mailed to me six to eight weeks after I open my account. To qualify for this bonus, all I gotta do is make a purchase within 60 days of opening my account. So, if I spend $100, that $100 gift card is on its way to me!

Just keep in mind that to get that sign-up bonus, I need to be a co-op member of REI. But hey, if I’m already a fan of the outdoors and shop there often, it’s a no-brainer! So, if I’m lookin’ to rack up some cash back while gearin’ up for my next adventure, the REI credit card might just be the ticket!

The REI Mastercard is a pretty sweet deal, givin’ me 5% cash back on all my REI purchases. But here’s the kicker: it’s a smart move to pair it with another rewards card that offers at least 2% cash back, like the Citi Double Cash Card. That one earns 2% back on purchases and has no annual fee, which is a solid incentive to grab the REI credit card, too. Sure, there are other cards out there with higher sign-up bonuses, but the REI Mastercard definitely has its perks.

If I’m lookin’ for a credit card with no annual fee, the REI Mastercard could be just the ticket for me. Since it doesn’t have an annual fee, I can transfer funds overseas without stressin’ about a penalty interest rate. Now, it does come with a 3% balance transfer fee, so it’s not completely free, but hey, it’s better than havin’ no bonus at all! I like to think of that fee as more of a convenience rather than a necessity.

REI offers a $100 introductory bonus as a signup incentive for its credit card. This is an extremely attractive signup incentive, and the card also offers 5% cash back on all purchases, including gift cards and items on sale. Besides that, the card also comes with a 10% REI discount. And with the $100 bonus card, you’ll be saving even more money. But there’s one caveat: REI’s rewards don’t post immediately. They’re distributed annually in March. Show me the money.

I recently purchased a kayak using my REI credit card, and it was a seamless and rewarding experience. As an avid outdoors enthusiast, I have been eyeing a kayak for quite some time. When I stumbled upon the REI credit card, I knew it would be the perfect way to fund my purchase while also earning rewards.

The process of using my REI credit card to purchase the kayak was straightforward. I simply added the kayak to my cart on REI’s website, entered my credit card information, and clicked “purchase.” Within a few days, the kayak was delivered right to my doorstep. Not only was the process easy, but I also earned rewards points for the purchase, which I can use towards future outdoor gear purchases. I had the cash but preferred to use the card.

There it was—an ocean kayak that seemed to beckon me, its sleek design and vibrant hue standing out among the rest. It was a 12-foot long sit-on-top model, known for its stability and comfort, perfect for the serene lake trips I had in mind. The specs were impressive: it boasted a lightweight yet durable polyethylene construction, weighing in at around 56 pounds, which meant I could handle it on my own during solo trips.

The kayak was equipped with a comfortable seat that promised hours of paddling without the usual lower back fatigue, adjustable footrests to accommodate my 6-foot frame, and a storage hatch that was just the right size for my gear—about 18 inches in diameter, perfect for stowing my lunch and a dry bag with essentials.

The sales associate at REI was incredibly helpful, sharing tips from his own kayaking experiences and advising me on the best paddle length to complement the kayak’s width, which was a generous 34 inches, ensuring stability. He also helped me select a PFD (personal flotation device), emphasizing the importance of safety on the water.

I left REI that day with the kayak securely strapped to the roof of my car, a sturdy pair of 230 cm paddles, and a sense of accomplishment.

Dividends

If you have a REI credit card, you can earn 10% back on purchases and receive a 15% dividend each year. That’s great, but you may have questions about your credit score. To get a good idea of your score, look up your credit report on U.S. Bank’s website. You can also request your dividends in cash or by check. The grace period is 24 to 30 days, and if you make purchases on your card during this time, you won’t be charged interest. Checks, however, are issued to cardholders only during the same time frame.

The REI Co-op Mastercard is another excellent option. It is associated with the REI Co-op, which gives cardholders the opportunity to earn 5% back on purchases. If you use your REI credit card frequently, you will also earn 2% back on purchases, as long as you spend less than $500. You will also receive 10% back on eligible purchases in 2020. This card is free, so it’s worth looking into.

Mobile wallet earning rate

The REI Mastercard offers a 2% mobile wallet earning rate, which is good for those who use Apple Pay, Samsung Pay, or Google Wallet to make purchases. The rate is not very high, but it’s better than nothing. Plus, new REI Mastercard holders can get a $100 REI gift card when they open an account within 60 days of joining the REI program. However, this isn’t a market-leading bonus.

The REI Credit Card also offers a free membership to LoungeKey, which offers free access to 400 airports in 120 countries. This membership is also optional, but it can save you a lot of money if you travel frequently. Additionally, you can access your credit rating through an online account. The report is only for educational purposes and cannot be used by banks to make financial decisions. However, if you have good credit, it’s well worth checking out the REI Mastercard.

Annual fee

The REI credit card doesn’t have an annual fee, but it does charge a balance transfer fee. Generally, 3% of the amount transferred is a standard rate on most credit cards. The minimum balance transfer is $5, and it works at all ATMs. The cash advance fee is 5% of the purchase price, with a maximum of $10. If you need to use the ATM, the REI card is a good choice.

The REI Co-op Mastercard packs a punch with a whole bunch of benefits! I’m talkin’ rental insurance, emergency support, and purchase protection—all the good stuff. Plus, it throws in trip cancellation insurance, travel assistance insurance, and fraud protection to keep me covered. And get this: I can even score some free REI merchandise through the REI Co-op World Mastercard! Signing up for an REI credit card is as easy as a few clicks—can’t beat that!

With the REI Mastercard, I get to enjoy all the perks of a credit card while doin’ some good for the planet. The company donates 10 cents from each transaction to its REI Foundation, which is a 501(c)(3) private foundation aimed at reconnectin’ underrepresented groups with nature, pushin’ for climate action, and promotin’ outdoor recreation. Just keep in mind that the amount of donations isn’t fixed, and any transactions posted late in December might not count toward that total.

Now, let’s talk cash back! The REI Co-op Mastercard earns me 5% cash back on purchases made with the REI co-op, and I also get 1% cash back on all other purchases. If I’m plannin’ to buy outdoor gear, this card is a fantastic option. It’s perfect for folks like me who love outdoor adventures and travelin’. Plus, with all those great benefits like travel insurance, it’s hard to go wrong!

To get approved for an REI credit card, I’ll need a credit score of around 700. They’ll look at my past negatives, recent inquiries, and current debts. But if I’m close to that score, I might still have a shot at qualifying. So, if I’m ready to gear up and hit the trails while rakin’ in some rewards, the REI Co-op Mastercard is definitely worth considerin’!

Capital One has $440 Billion in assets.

It offers financial services like loans and credit cards. It is in the S&P 100 and trades on NYSE as COF.

You are allowed to have more than one cards from them, as many as your standing will allow.

In 2021 REI had $3.7 Billion in sales with net income of $98 million. They have 178 stores in 42 US states and 20 Million members.

FAQ

Cashback Rewards:

-

5% Back on REI Purchases: With the REI Co-op Mastercard, I earn a sweet 5% back on all my REI purchases. This reward comes as a statement credit, and it’s on top of the regular REI member dividend, which means I could be lookin’ at up to 15% back on my REI buys—now that’s a deal!

-

2% Back on Mobile Wallet Purchases: If I’m usin’ my card with a compatible mobile wallet like Apple Pay or Google Pay, I’ll snag 2% back on those purchases. Easy peasy!

-

1% Back on All Other Purchases: For all my other eligible purchases, I get 1% back. It’s a nice little bonus for everyday spending.

These rewards add up and are issued annually as a member reward, which I can then spend at REI.

Charitable Donations:

Every time I whip out my REI Co-op World Elite Mastercard, REI donates to the National Forest Foundation. That helps support projects that improve and enhance our National Forests and Grasslands—feels good to give back!

No Annual Fee:

One of the best parts? This card doesn’t have an annual fee. That’s a big win if I plan to use it regularly without any extra costs.

Travel and Purchase Protections:

As a World Elite Mastercard, this card comes with a whole suite of benefits:

- Travel Accident Insurance: I’m covered in case of accidental death or dismemberment while travelin’ on a common carrier (like planes, trains, ships, or buses).

- Auto Rental Collision Damage Waiver: If I rent a car using my card, I get secondary coverage for damage from collision or theft.

- Extended Warranty: I get extra warranty protection at no charge on eligible purchases—can’t complain about that!

No Foreign Transaction Fees:

This is a real gem if I’m travelin’ abroad since many cards hit ya with about 3% on purchases made outside the U.S. Not here!

Emergency Card Services:

If my card gets lost or stolen, I can get an emergency card replacement and even a cash advance. That’s peace of mind right there.

Zero Fraud Liability:

I’m not responsible for any unauthorized transactions if my card is lost or stolen. Talk about a safety net!

REI Co-op Member Reward:

I’ll receive my REI Co-op Member Reward annually, which I can spend on all the cool gear at REI.

Application Process:

-

Online Application: I can apply for the REI Co-op World Elite Mastercard right on REI’s website. They’ll ask for my personal info, like my name, address, phone number, Social Security number, and income. Gotta make sure I’m bein’ accurate and truthful!

-

Credit Check: When I apply, U.S. Bank will do a credit check to see if I qualify for the card and set my credit limit and interest rate.

-

Approval: Sometimes, I’ll get an instant approval, but if they need to review my application further, I might have to wait a few days to a week for a decision.

Customer Service:

U.S. Bank handles customer service for the REI Co-op World Elite Mastercard. If I have questions about my account or need help with my card, I can reach out to them. They also offer online account management where I can check my balance, make payments, view transactions, and manage my account.

Mobile App:

U.S. Bank has a mobile app that lets me manage my REI Co-op World Elite Mastercard right from my smartphone. I can check my account balance, make payments, set up alerts, and more—all at my fingertips!

I can load up on all kinds of gear for my outdoor adventures! Here’s a rundown of what I can snag:

Camping & Hiking:

- Tents: Perfect for catchin’ some Z’s under the stars.

- Backpacks: Can’t hit the trails without a good pack to carry my stuff.

- Sleeping Bags: Gotta stay warm and cozy while I’m campin’ out.

- Hikin’ Boots: Essential for stompin’ around in the great outdoors.

- Camping Cookware: For whippin’ up some good grub at the campsite.

- GPS Units: Ain’t no way I’m gettin’ lost out there!

- Other Camping Essentials: Think lanterns, first-aid kits, and all that good stuff.

Cycling:

- Bicycles: Whether I’m into mountain bikes, road bikes, or hybrids, I can find it all.

- Cycling Clothing: Need some comfy gear for those long rides, y’know?

- Helmets: Safety first, partner!

- Bike Components: Everything from tires to brakes—gotta keep my ride in tip-top shape.

- Accessories: Lights, locks, and all the little extras that make ridin’ easier.

Paddling:

- Kayaks and Canoes: Perfect for floatin’ around on lakes and rivers.

- Paddleboards: Great for some fun on the water when I wanna chill.

- Life Jackets: Safety’s key when I’m out there paddlin’.

- Paddles: Can’t go anywhere without ‘em!

- Other Water Sports Gear: Think dry bags and waterproof cases for my stuff.

Climbing:

- Climbing Shoes: Can’t be climbin’ without the right kicks!

- Harnesses: Safety gear is a must when I’m scaling rocks.

- Carabiners: For keepin’ myself and my gear secure.

- Helmets: Protectin’ my noggin while I’m up high.

- Ropes: Essential for any serious climbin’.

Running:

- Running Shoes: Need some comfy kicks for hittin’ the pavement or trails.

- Clothing: Breathable gear that won’t weigh me down.

- Hydration Packs: Gotta stay hydrated on those long runs.

- Fitness Trackers: Keepin’ tabs on my progress and stats.

- Other Running Accessories: Like headbands and reflective gear for safety.

Fitness:

- Yoga Mats: Perfect for my yoga sessions or workouts.

- Fitness Clothing: Gear that moves with me, no doubt.

- Resistance Bands: Great for buildin’ strength on the go.

- Weights: For pumpin’ iron and stayin’ fit.

- Other Fitness Equipment: Think foam rollers and exercise balls.

Snow Sports:

- Skis and Snowboards: Ready to hit the slopes and have some fun!

- Snowshoes: For trekking through the winter wonderland when it’s chilly.

- Winter Clothing: Keepin’ warm with jackets, pants, and layers galore.

- Goggles and Helmets: Protectin’ my eyes and noggin’ while I ride.

- Other Winter Sports Gear: Like gloves, socks, and all that jazz.

Travel:

- Luggage: Durable bags for all my adventures.

- Travel Clothing: Comfy and practical gear for the road.

- Travel Accessories: Like packing cubes and travel pillows—can’t forget those!

- Books and Maps: For planning my next trip and explorin’ new places.

Men’s, Women’s, and Kids’ Clothing and Footwear:

- Jackets, Shirts, Pants, Shorts: Gear made for outdoor fun, y’all.

- Shoes, Boots, and Sandals: Footwear for any occasion, whether I’m hikin’ or chillin’.

Outdoor Electronics:

- GPS Units: For navigatin’ on my adventures—ain’t gettin’ lost on my watch!

- Action Cameras: Gotta capture all the memories while I’m out there.

- Drones: For some epic aerial shots of my escapades.

- Portable Chargers: Keepin’ my devices powered up while I’m on the go.

- Weather Instruments: Stayin’ informed about the conditions—don’t wanna get caught in a storm!

REI rocks! I do like to browse their store. I get a few small items. I order bigger more expensive items online, usually from amazon because they have good prices and free delivery.

I picked up a waterproof dry bag, a carbon fiber paddle, pfd, and sunglasses.

I spent about $700 to get all the kayak gear I needed.

I picked up a creditcard app from the store. I never filled it out because I already have a few cards. I did look at it, but I would not use it that much. I like to shop there but use the store as an amz showroom.

The store in Austin has big selection of mtbs, kayaks, tents, and everything. I love to browse.

You can never have too many flashlights, sunglasses, mini tools, frisbees, water shoes, cookware, pumps, helmets, and layered water wikiing shirts.

I like REI more than Dicks and Academy. The staff seems way more knowledgeable. Pricewise they are on the higher end. You can wait for a sale like I do. Academy has more clothing. Dicks has much more fishing gear and lures. REI has bike line and kayaks. You can use any card there.

Have you every compared prices?

All retail stores charge more vs shopping online.

I bought a camera and they did match the online price, they wanted 399, I found it on amazon for 349 and they matched that so I bought from them to get it same day. I like the climbing wall at Dicks. It looks like fun but not safe so I just watch.

Wow, that kayak sounds like an incredible find! I love how you described its sleek design and vibrant color—it definitely sounds like it would stand out on the water. A 12-foot sit-on-top model is such a great choice for lake trips, especially with its stability and comfort features.

Have you had a chance to take it out on the water yet?