I learned about the whole approval process trying to get one. It’s pretty straightforward, but there are definitely some things to keep in mind.

Credit Score Requirements

First off, the minimum credit score to apply is 560. Now, I gotta be real with you—while you can technically apply with a score this low, it’s like rollin’ the dice. Your chances of gettin’ approved are way better if you’ve got a score of at least 600. That’s where I aimed when I was lookin’ to apply.

-

Why 600? Well, a score in the 600s shows the credit folks that you’ve got some decent history and you’re not just a credit newbie. It’s like a solid middle ground that gives you a better shot.

-

670 and Up: If you’re sittin’ at a score of 670, you’re in the preferred zone. This is where things start to get really good. You’ve got a better mix of credit accounts, and lenders see you as a reliable borrower.

-

720 and Higher: If you can hit 720, you’re lookin’ at an excellent score. This is where you start to unlock some serious perks, like better interest rates and awesome rewards.

-

800+: And if you’re one of those high-flyers with an 800+ score? Man, you’re golden! You’re practically a credit rockstar, and you’ll breeze through approvals on just about any card, including the Southwest card.

Income Matters

Now, here’s the kicker: even if your credit score is on the lower end, having a higher income can work in your favor. The folks at Southwest want to see that you can pay off your balance each month. So, if you’ve got a decent paycheck comin’ in, that can help boost your chances of approval, even if your score isn’t perfect.

Pay Off That Balance

One thing I learned along the way is that if you can show you’re responsible with your finances—like payin’ off your balance every month—then you’ll be in a much better position. It’s all about demonstrating that you can handle credit wisely, especially for personal use cards.

My Takeaway

So, if you’re eyeing that Southwest Airlines credit card, make sure to check your credit score first. If you’re sittin’ at 600 or above, you’re already in a good spot.

I recently had the opportunity to fly on Southwest Airlines for the first time. As someone who frequently travels by air, I was excited to see what this popular low-cost carrier had to offer. From the moment I stepped onto the plane, I was impressed by the friendly and welcoming atmosphere.

One of the things that stood out to me about Southwest was their unique boarding process. Instead of assigned seats, passengers are assigned a boarding group and number, and are free to choose any available seat once they board. While this may seem chaotic, I found it to be a refreshing change from the usual rush to claim a specific seat. It also gave me the opportunity to meet and chat with other passengers as we looked for seats together.

Booking a flight on Southwest’s website was a breeze. The homepage was clean and easy to navigate, with clear options for selecting departure and arrival locations, dates, and number of passengers. I appreciated the ability to filter by nonstop flights and the option to search for flights within three days of my chosen date.

After selecting my flights, I was presented with a clear breakdown of the fare and any additional fees, such as early bird check-in or baggage fees. It was easy to compare different fare options and select the one that worked best for me.

Unlike other credit card companies, Southwest doesn’t publish a specific formula for qualifying applicants. Their approval process is based on the CARD Act, which requires credit card companies to verify applicants’ income. Southwest is more interested in your debt-to-income ratio, which is a standard measure used by all lenders. If you have high income but low credit, you may want to consider applying for a different card, but don’t expect the airline to approve your application.

Here’s a little nugget of wisdom: if you miss just one credit card payment, it can drop your score by up to 100 points! Ouch, right? To avoid that heartache, I highly recommend setting up automatic payments. This way, you’ll never miss a due date, and you can keep your credit score on the up and up.

My Strategy

So, if you’re thinkin’ about boosting your credit score, consider going for a co-brand airline credit card. It’s a smart way to build your credit while earning some travel rewards. Just keep your payments on point, and you’ll be well on your way to better credit and those sweet airline perks! Safe travels, my friends!

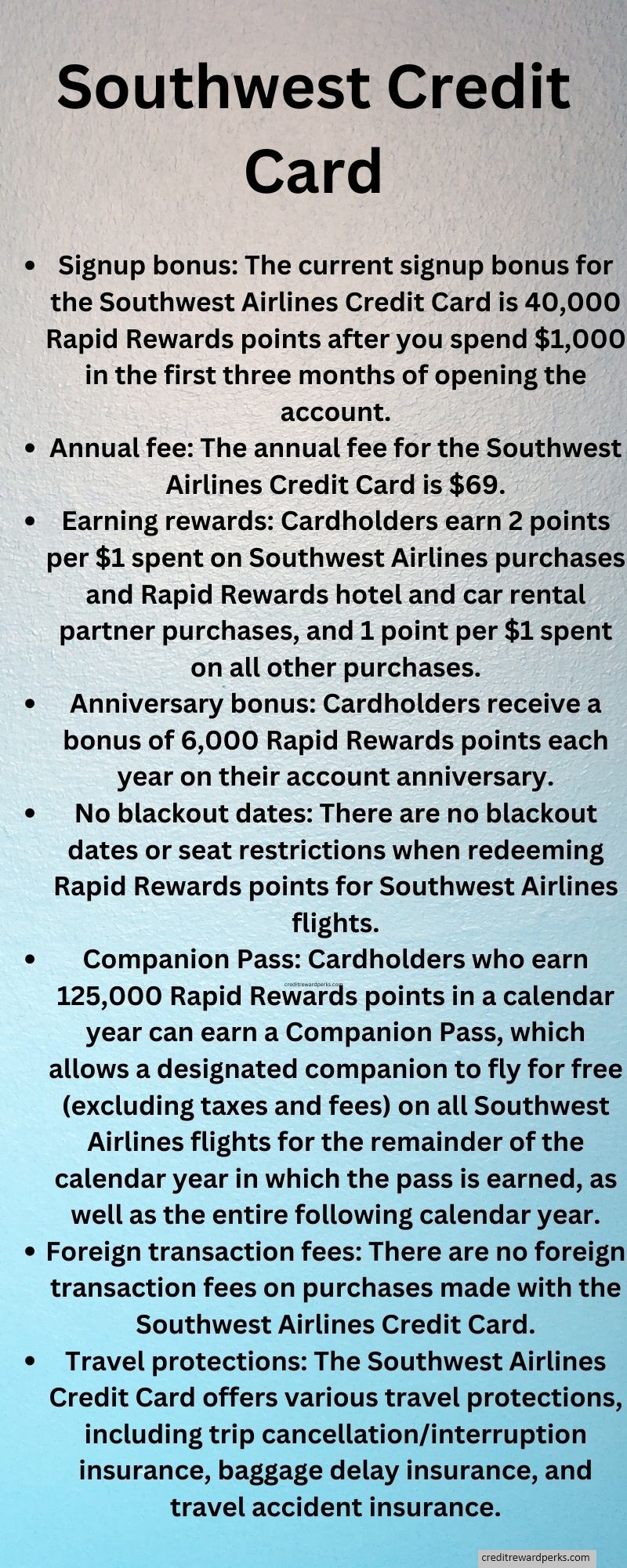

How to Get a Southwest Airlines Credit Card

If you’re a frequent traveler, you can choose a Southwest Rapid Rewards Visa Signature card. Its reward program offers tens of thousands of points, which can be redeemed for flights. However, Southwest points are not worth as much as the ones of other airlines. In order to get the maximum rewards, you’ll need a good income and a high credit score. So, you’ll need to choose one of these cards based on your spending habits.

A credit card with Southwest offers many benefits. One of these perks is extended warranties for eligible purchases. This coverage lasts for 120 days and protects you up to $500 in damages. It also carries purchase protection, which means you can get a free flight. It’s important to note that you’ll need to cancel an existing card before your bonus is fully reflected in your credit report. Otherwise, it’s possible to get a bonus from a new card.

While there are no specific guidelines for getting an airline credit card, you can get one with lower requirements for a credit score. These credit cards are co-branded by major airlines and are issued by these companies. Those with good credit can apply for one of these credit cards, and a high credit score might improve your chances of getting approved for one. However, it’s important to know that you can’t apply for every Southwest Airlines credit card that comes along with an airline buddy pass.

The Rewards Calculator For Southwest Airlines Credit Cards

If you’ve ever wanted a credit card that gives you the best perks possible, consider the Southwest Airlines credit card. You can earn 60,000 Rapid Rewards points, get upgraded boardings and 9,000 bonus points. You can even earn $75 in travel credit with this card. But, before you sign up for the Southwest credit card, there are several things you should know. The rewards calculator assumes that you will fly exclusively on Southwest. Other carriers will not earn points on your card.

60,000 Rapid Rewards points

There are three different ways to earn 60,000 Rapid Rewards points on a Southwest Airlines credit card. Priority credit cards offer a $75 Southwest credit every year, while the Premier and Xtra cards both offer a 25% in-flight discount. Those who choose the Premier credit card will also receive two free EarlyBird Check-Ins per year. Both cards earn tier-qualifying points (TQPs), but only the Xtra card offers double the points.

The Premier card offers a few extra perks, like seven hundred points for your anniversary and four free upgraded boardings every year. This card also provides a $75 annual travel credit for purchases on Southwest and their partners. This credit is good for all Southwest purchases, but does not apply to award flights or in-flight purchases. If you decide to use the Rapid Rewards Premier card, make sure to make all of your purchases on the airline.

Four upgraded boardings

If you’ve ever wanted to fly first class, you might want to use a Southwest Airlines credit card to make your experience that much better. This card reimburses you for up to four A1-A15 upgraded boardings per calendar year. The fee for this upgrade is $30 to $50. Additionally, you can get 20% off alcohol and other in-flight purchases with your card. You can purchase these upgrades at the ticket counter or at the gate.

In addition to the Southwest Priority Credit Card, you can also earn 2X Rapid Rewards on car rental and hotel purchases. These perks can make the process of reaching A-List status much faster. With this card, you’ll also receive a $75 annual travel credit. In addition, you’ll receive 80,000 bonus points after three months of purchases. This means you’ll be halfway to earning your Companion Pass.

9,000 bonus points

Using a credit card from Southwest Airlines can earn you rewards for flying and shopping. You can earn 9,000 bonus points when you spend $5,000 or more on the card within the first three months of account opening. The card comes with a variety of other benefits, including four boarding upgrades per year and statement credits for Global Entry application fees. There are no foreign transaction fees on the card, which can help you avoid paying high foreign transaction fees.

The best way to maximize your Southwest credit card points is to make all purchases on the card through the company website. It will give you three points for every dollar of your purchases with the airline, and it also offers 2x points for other purchases, including local transportation and hotels. You can also use the card for discounts on in-flight purchases and enjoy 25% statement credits. The best part of using a credit card issued by Southwest is that it offers the best welcome bonuses for new cardholders. The 9,000 bonus points offer is only available until December 7, 2021, so take advantage of it while you can.

$75 travel credit

You can get a $75 annual travel credit on the Southwest card by enrolling in the Rapid Rewards program. The credit is redeemable on most Southwest purchases, but not on in-flight purchases or upgrades. However, you have to be careful when using the credit near the end of the anniversary year, as you may be charged for the extra travel. However, it’s well worth it if you have a Southwest card.

If you travel to the Southwest airline frequently, you might consider getting the Southwest Priority Credit Card. It carries a $149 annual fee, but the bonus of $75 is well worth the price of the card. The card also comes with other benefits, including upgraded bookings and Early Bird priority boarding. However, the $75 credit on Southwest Airlines flights is worth every penny of the card’s annual fee. Its other perks are well worth the $149 fee.

SWA

Southwest Airlines is so friendly that even their planes have a “smile” on their face – just check out the red and blue “heart” logo near the nose of the aircraft! ❤️✈️

They don’t assign seats on their flights, so it’s a bit like playing musical chairs in the sky. Get ready to practice your aisle-sprint and window-leap!

If you’re a fan of freebies, Southwest Airlines is the place to be. They’re known for their free checked bags and in-flight snacks, so you’ll never go hungry or worry about squeezing that extra souvenir into your carry-on.

Southwest flight attendants are known for their sense of humor, making the safety demonstration feel like a comedy show. Pay attention, and you might just learn something new while having a laugh!

You know you’re flying Southwest when they announce, “There are 143 seats on this aircraft, but only one with extra legroom. Good luck finding it!” It’s like a game of hide-and-seek, but for adults!

USA Government official site credit score and reports info

Equifax – how credit scores are used

FAQ

1. What is the Southwest Airlines Rapid Rewards credit card?

It’s your passport to airline points paradise. A card that transforms your everyday expenses into your next dream getaway. You’ll earn Rapid Rewards points on your purchases, which you can redeem for flights and more on Southwest Airlines.

2. What rewards can I earn with the Southwest Airlines Rapid Rewards card?

With this card, you’re like an points archeologist, uncovering treasures on every purchase. You can earn points on all purchases, with extra points awarded for Southwest and partner hotel and car rental purchases.

3. Is there an annual fee for the Southwest Rapid Rewards card?

There is an annual fee, but Southwest offers several different cards with various benefits and fees. Some cards offer more perks for a higher fee – it’s like choosing your seat on the plane. Do you want the economy seat or the first-class experience?

4. Is there a sign-up bonus?

Yes, Southwest usually offers a sign-up bonus to welcome you aboard. It’s like getting a first-class upgrade, but with points!

5. Can I use my Southwest Airlines Rapid Rewards card anywhere?

You bet! You can use your Southwest Rapid Rewards card anywhere Visa is accepted, so you can earn points whether you’re dining out, buying groceries, or splurging on a new pair of hiking boots.

6. How do I apply for a Southwest Airlines Rapid Rewards card?

You can apply online – it’s as easy as booking a flight! Just visit the Southwest Airlines credit card website, choose the card you want, and fill out the application.

7. What can I redeem my Rapid Rewards points for?

With Rapid Rewards points, you can book flights, hotel stays, car rentals, gift cards, access to events, and more. It’s like having a magic wand that turns your spending into amazing experiences!

8. Do my Rapid Rewards points expire?

No, your points will not expire as long as your Rapid Rewards account remains open. That’s right, they’re immortal, like the vampires of rewards points – without the whole nocturnal thing!

9. Are there blackout dates for using my points?

No, there are no blackout dates for reward travel. So, you can fly when you want, as long as there’s a seat available. It’s like having the power to time travel, but only forward, and only on a commercial airline.

10. Can I earn tier qualifying points (TQPs) with my Rapid Rewards credit card?

Yes, certain Southwest Rapid Rewards credit cards allow you to earn TQPs towards A-List and A-List Preferred elite statuses, which come with additional benefits. It’s like leveling up in a video game, but the game is travel, and the power-ups are things like priority boarding.

11. Does the Southwest Rapid Rewards credit card offer any special benefits on Southwest flights?

Yes, depending on the card you choose, benefits may include free checked bags, anniversary points, and inflight discounts. It’s like being a VIP at the best flying party ever!

![Benefits of REI Credit Card [Bonus and Cash Back Dividends]](https://creditrewardperks.com/wp-content/uploads/2022/04/shutterstock_10564236501b.jpg)

I love SW. I like the comfy 737s and friendly attendants. I have always turned down the cc app they try to give you on each flight. Now I am thinking it is worth it just for the bonuses and perks. I never did like open seating and it sucked getting on last in group C. Once I was dead last and still got a exit row seat I guess no body noticed it was open.

In the 90s SW flew out of the 2nd DFW airport. You could take a short flight only. I flew from Chicago with 2 stops, so ends up taking few extra hours. At the time, it was a good deal. I would totally get this card if I used them more. I mainly fly Delta and United due to scheduling.

What happens on the flights? Do you get snacks? Do you bring a ped and geek out? I find that air travel is grueling. I do like the paint colors on the aircraft, its way better than plain white.

The could just not use a point system and give everyone 5 percent lower prices. I guess that is too easy. Or just follow the system. The main deal I want is a better seat. I prefer exit row, window, in middle or front.

My recent score was 702. Is that good enough? I had some payment issues 5y ago that should go away in 2 more years. I guess I can wait. I like to jump from Houston to Florida a few times a year. I can usually get a flight for 150 or less each way.

How should I handle my boss wants to use AA and I like SWA. We are going on a trip but separate airlines. It is weird. What is your recommendation?

When I moved to the southwest part the US. I learned all about SWA. When I moved back to big D they were bigger than before. I am glad I found your post. Do they allow family members on the same card?

I adore SW. I was able to get in A group with company contacts. So I could get a window seat. I like the funny FA. I was on a flight the the FA was singing, no sht.

Do they still offer big lump sum of points if you join? and what is it really worth?

SW has some problems. They use an ancient booking system that crashes causing huge lines and delays and they really need to fix that. They used to have low prices but now they are the same as others. One thing I do like is last minute deals. Bigger airlines like Delta and United need 2 weeks notice for discount. I have got deals with 3d notice on SW. Also big comparison engines to not include them so you have to remember to go to their site and get quote.