I have been rejected for some exclusive cards. I was successful with persistence.

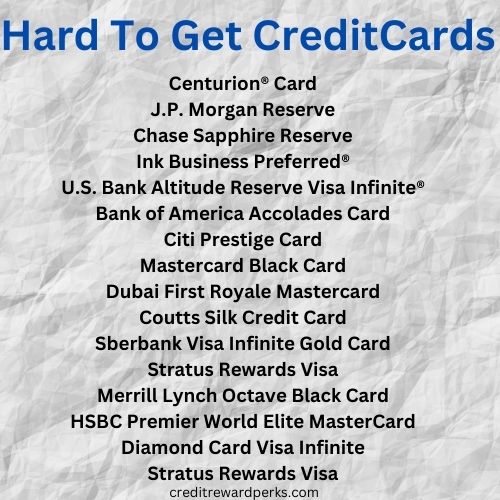

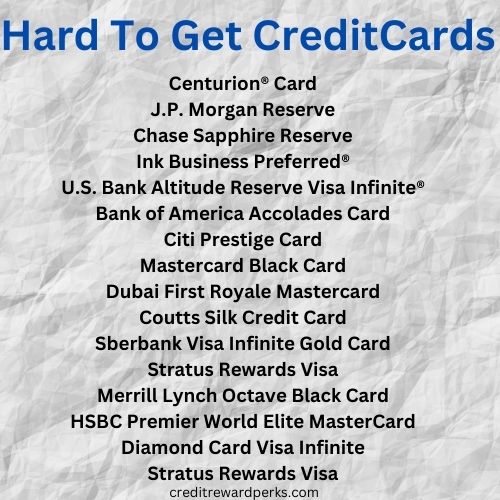

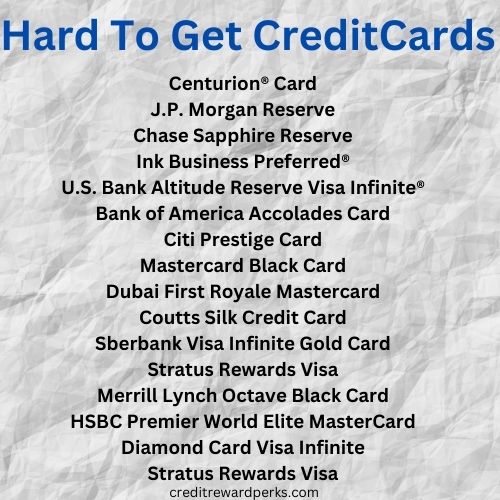

15 Hardest Credit Cards to Obtain

-

American Express Centurion Card

- Approval Rate: Invite-only; requires significant annual spending (often over $250,000).

- Comments: Known as the “Black Card,” it offers exclusive benefits and services, making it one of the most prestigious cards available.

-

J.P. Morgan Reserve Card

- Approval Rate: Invite-only; requires significant assets with J.P. Morgan (often over $10 million).

- Comments: Offers premium travel benefits and concierge services, but access is highly restricted.

-

The Platinum Card from American Express

- Approval Rate: Low; requires excellent credit (typically a score of 700+).

- Comments: Extensive travel benefits, but high annual fees and strict income requirements make it hard to obtain.

-

Chase Sapphire Reserve

- Approval Rate: Low; requires excellent credit (usually 720+).

- Comments: Offers high rewards for travel and dining, but the stringent approval process can be a barrier for many.

-

Citi Prestige Card

- Approval Rate: Low; requires excellent credit.

- Comments: Premium travel rewards, but the high annual fee and credit requirements make it difficult to get.

-

American Express Business Platinum Card

- Approval Rate: Low; requires excellent credit and a viable business.

- Comments: Offers extensive travel perks for business owners, but the approval process is rigorous.

-

Chase Ink Business Preferred Credit Card

- Approval Rate: Low; requires excellent credit and a solid business history.

- Comments: High rewards for business expenses, but difficult to qualify for without a strong credit profile.

-

American Express Gold Card

- Approval Rate: Moderate to low; requires good to excellent credit.

- Comments: Offers premium rewards and dining benefits, but approval can be challenging for those with limited credit history.

-

Barclaycard Arrival Plus World Elite Mastercard

- Approval Rate: Moderate; requires good credit.

- Comments: Strong travel rewards, but the high credit requirements can be a barrier for some applicants.

-

Gold Delta SkyMiles Credit Card from American Express

- Approval Rate: Moderate; requires good credit.

- Comments: Ideal for frequent Delta flyers; however, approval may be difficult for those with lower credit scores.

-

Capital One Venture Rewards Credit Card

- Approval Rate: Moderate; requires good to excellent credit.

- Comments: Strong travel rewards, but higher credit scores are necessary for approval.

-

Discover it Miles

- Approval Rate: Moderate; typically requires good credit.

- Comments: Offers travel rewards, but the approval process may be stringent for those with limited credit history.

-

Citi Double Cash Card

- Approval Rate: Moderate; good credit typically required.

- Comments: Simple cash back structure, but can be difficult to obtain for those with average credit scores.

-

Chase Freedom Flex

- Approval Rate: Moderate; requires fair to good credit.

- Comments: Offers rotating categories for cash back rewards, but approval can be challenging for those with limited credit history.

-

Wells Fargo Propel American Express Card

- Approval Rate: Moderate; requires good credit.

- Comments: Comprehensive rewards across various categories, but the approval process is strict for lower credit scores.

Centurion Card from American Express

The Centurion® Card from American Express is the crème de la crème of credit cards in the good ol’ US of A. This exclusive card is invitation-only, meaning you can’t just waltz in and apply for it like you would with other cards. The features and benefits that come with this bad boy are top-notch and hard to find anywhere else. If you’re thinkin’ about snaggin’ an invitation, stick around to learn what you gotta do. This card is perfect for frequent travelers, business folks, and high rollers who like to spend big.

Now, let me tell ya, the Centurion Black card is a tough cookie to crack compared to the other Amex cards. You can’t just apply for it like you would the Gold or Platinum cards. Nope! You need to know someone who already has one, or you can apply if you work for a company that partners with American Express. The requirements are stricter, so it’s definitely not for everyone.

Before you even think about applyin’ for the Centurion Card, if you’re already an American Express cardholder, it’s a smart move to clear your balances on your other cards. This way, those zero balances get reported to the major credit bureaus, givin’ you a better shot. But keep in mind, just because you apply doesn’t mean you’ll get an invitation. The Centurion membership interest page is a good resource, but it ain’t a guarantee. You might also need to spend a hefty amount on your other cards to even be considered.

When you do get the card, you’ll be lookin’ at a variety of offers from top brands, like free shipping and same-day delivery in NYC. Plus, you can explore a whole range of destinations by checkin’ out The List, which gets updated regularly. Whether you’re lookin’ for fancy restaurants, shopping hotspots, or cultural gems in each city, you’ll find some great deals for your next adventure.

So, if you’re ready to roll with the best of the best and think you can meet the criteria, keep your eyes peeled for that invitation!

I recently applied for the American Express Centurion Credit Card, also known as the “Black Card,” and was disappointed to find out that my application was not approved.

As someone who enjoys the perks and benefits of premium credit cards, I was excited about the possibility of owning one of the most exclusive cards in the world. However, my application was denied for reasons that were not immediately clear to me.

I did some research and found that the Centurion Card is not only difficult to obtain, but also comes with a hefty annual fee and strict eligibility requirements. Despite having a high credit score and a substantial income, I was still not deemed eligible for the card. This experience made me wonder about the qualifications and criteria used.

Alexander, Tech Entrepreneur from Silicon Valley

“After years of building my tech startup into a successful enterprise, I was finally able to apply for the Centurion® Card from American Express, commonly known as the Amex Black Card. It’s known for being one of the hardest cards to get, with an invitation-only policy and hefty annual fees. The moment I received my personalized metal card, I knew that my hard work had paid off. The dedicated concierge service and exclusive travel benefits have been game-changers for both my business and personal life.”

J.P. Morgan Reserve Credit Card

The J.P. Morgan Reserve Credit Card is one of the most exclusive cards on the market. To be accepted, applicants must be enrolled in the private bank’s wealth management program and have a minimum of $10 million in investable assets, planinvestescape.com. As an invite-only card, this card has strict guidelines and is not readily available to everyone. While the application process is lengthy and rigorous, the rewards program can help you improve your financial situation.

The J.P. Morgan Reserve Credit Card comes in a well-sealed package. It is centered within a rectangular casing. The card is fairly well-built and weighs only 27 grams. It does, however, come with an annual fee of $125. In addition, it requires that you have more than $10 million in assets with Chase to qualify for the card. After you qualify for the card, you can begin collecting points and rewards.

While the Chase Sapphire Reserve has similar benefits, the J.P. Morgan Reserve is harder to obtain. If you have a $10 million in assets, you can apply for the card to receive 80,000 bonus points after you spend $5,000. You can then redeem those points for $1,000 using Chase Ultimate Rewards. However, getting the J.P. Morgan Reserve is not easy, so you should not expect instant gratification.

I received the rejection letter for the J.P. Morgan Reserve CC. It was an overcast Tuesday afternoon, and I had just returned from a hectic day at work, my spirits buoyed by the anticipation of possibly being approved for this exclusive piece of financial prestige.

The Card, after all, is not your run-of-the-mill credit card. Known for its hefty $595 annual fee and requiring an invitation to apply, it’s a card that’s synonymous with luxury and exclusivity, typically reserved for high-net-worth individuals. Its sleek design, with a palladium metal core, gives it a substantial weight and a distinctive presence compared to the standard plastic cards. The card is said to weigh around 27 grams, which is about the weight of five quarters in your hand—a small detail, but one that I was looking forward to feeling every time I reached for my wallet.

As I tore open the envelope with a mix of excitement and trepidation, I couldn’t help but think back to the meticulous care I had taken in preparing my application. I had double-checked every detail, ensured my credit score was in excellent standing, and even highlighted my history of responsible credit use on premium cards with high limits. I had been confident that my financial profile would pass the scrutiny of the Chase Private Bank, which issues the card.

But as my eyes scanned the letter, my heart sank. There it was, the word “denied,” standing stark and unyielding on the page. I felt a mix of emotions—disappointment, certainly, but also a touch of confusion. What had I missed? Where had I fallen short? The letter was polite but offered little in the way of explanation, citing only that my current assets under management with the bank did not meet their threshold for issuing the card.

I sat down at my kitchen table, the letter still in hand, and pondered the situation. I had heard that one typically needed at least $10 million in investable assets with J.P. Morgan to be considered for the card. While my finances were solid, I wasn’t quite at that level. It was a sobering reminder that some doors in life have very specific keys, and this time, I didn’t have the right one.

The rejection, however, didn’t dampen my resolve. Instead, it served as a catalyst, a challenge to grow my investments and financial acumen. I began reading more about wealth management, diversifying my portfolio, and seeking new opportunities for financial growth. The J.P. Morgan Reserve Card had become more than just a status symbol; it was a milestone I set for myself—a goal to work towards in my financial journey.

Chase Sapphire Reserve

f you’re lookin’ to snag a premium credit card, you might wanna set your sights on the Chase Sapphire Reserve. This card brings a whole lotta benefits to the table, like lounge access and a sweet bonus of 50% when you redeem your points. Sounds great, right? But hold your horses—there are some downsides, too, like that hefty annual fee and higher spending requirements. With those factors in play, it might be a bit tricky to get approved. If you’re not ready to drop that kind of cash, you might wanna check out other, less expensive options from Chase, like the Sapphire Preferred.

Now, if your credit history is spotless, you’ve got a good shot at qualifying for the Chase Sapphire Reserve. But if you’re not a high-earner or you’ve got a low income, this card might not be the best fit for you. With that high annual fee and other requirements, it’s really not ideal for folks who only plan to make small purchases and carry a balance.

However, for those who travel a lot, this card can be a game-changer. It comes with perks like airport lounge access, pick-up and delivery services, and discounts on transportation. So, if you’re always jet-settin’ and lookin’ for a little extra comfort and convenience on your travels, the Chase Sapphire Reserve could be just the ticket! Just make sure you weigh the costs and benefits before you dive in.

The Chase Sapphire Reserve comes with higher credit score requirements compared to the Chase Sapphire Preferred® Card. To get approved for this card, you typically need a credit score of 720 or higher. Now, don’t fret if you’re sittin’ below that score—some folks with scores under 720 can still get approved, but it usually doesn’t happen right away. So, if you’re lookin’ to boost your chances of snaggin’ that Reserve card, I’ve got some tips to help you improve your credit score. Let’s dive in!

First things first, before you apply for the Reserve, take a good look at your credit history. You wanna make sure you’ve got at least two credit cards in good standing with Chase. They’re not too keen on applications that are maxed out, so if you’ve got any cards that are sittin’ at their limits, it’s time to pay those off ASAP. This is crucial for your overall credit score since it’ll reflect your current creditworthiness.

If your credit score takes a hit, don’t sweat it—just work on improving it, and you can always apply for the Reserve again down the line. Just remember to consider applying for the Reserve card before you go after any other credit cards. That way, you’ll be in a better position to make the most of this premium card when you finally get it! Happy credit building, y’all!

Raj, Venture Capitalist from San Francisco:

“The world of venture capital is fast-paced and requires a credit card that can keep up with spontaneous travel and client entertainment. I set my sights on the Chase Sapphire Reserve® because of its substantial travel rewards and luxury benefits. Achieving this card required a strong credit history and a strategic approach to my finances. Once approved, the card significantly elevated my travel experiences with its lounge access and premium travel protections.”

Ink Business Preferred® Credit Card

If you’re thinkin’ about gettin’ a new credit card, you might wanna check out the Ink Business Preferred® Credit Card. This card comes with a whole heap of benefits that make it a solid choice for business folks. First off, its rewards program is super flexible, and you can transfer points to various hotel and airline programs—now that’s handy!

One of the best parts? The Ink Business Preferred Credit Card has no annual fee, and you can request up to three free cards for authorized users. Plus, you can set spending limits on all those purchases, which is great for keepin’ track of expenses. Oh, and let’s not forget the cell phone insurance policy—it’s a nice little bonus for those of us who can’t live without our phones!

For most businesses, this card offers some serious bang for your buck. The sign-up bonus is generous, and it rewards users on common purchase categories, which is perfect for companies with moderate expenses. Now, while the annual fee can be a bit steep, it’s definitely worth it if you’re lookin’ to maximize those bonus points and redeem ‘em for travel with Chase Ultimate Rewards.

This card isn’t for everyone, though. It’s best suited for folks who spend a fair amount on business expenses. If that sounds like you, the Ink Business Preferred Credit Card could be just what you need to take your business spending to the next level!

U.S. Bank Altitude Reserve Visa Infinite® Card

The U.S. Bank Altitude Reserve Visa Infinite® Card is a credit card that offers multiple benefits. Among these are airline credit, concierge services, extended warranty protection on purchases, price protection, and travel assistance insurance. All of these benefits are valuable, but if you find yourself paying too much interest or racking up late fees, the card may not be worth the hassle.

You must be an existing customer of U.S. Bank for five days prior to applying for the card. This means that you must already have a checking or savings account, mortgage, or credit card. You also have to be present to receive the card. In addition, the card offers valuable sign-up bonuses, but it may be out of reach for most people. You can also get the card through a direct application with the bank.

Citi Prestige Card

The Citi Prestige Card is a high-end credit card that earns you ThankYou points, which can be redeemed for gift cards or airline miles. These points are also transferable to select airline loyalty programs. You can redeem your points for travel, student loan and mortgage payments, or even donate them to a charity. The Citi Prestige card also offers a host of benefits, such as lounge access, an annual travel credit, and more. However, you will find it hard to get.

The card features a lucrative rewards program with 5x points for dining and three times for air travel and hotels, as well as a lower annual fee of $495. Another benefit of the card is its easy redemption options. You can redeem your Citi ThankYou points for statement credits, mortgage or student loan payments, merchandise, or even gift certificates at select retailers.

Platinum Card from American Express

A Platinum Card from American Express has a high signup bonus, typically between 100,000 and 150,000 Membership Rewards points. This bonus can be worth around $1,500, depending on how you redeem them. You will also need to spend a minimum of $6,000 in the first six months to receive the bonus. If you don’t plan on using the card much, this bonus may be too low for you.

The benefits of the Platinum Card from American Express are plentiful. This card offers perks to frequent travelers. The highest-end hotels and airlines reward its users with elite status. Although the card comes with an annual fee of $695, you can make the fee worth it by maximizing the benefits. You will be able to use airport lounges, enjoy complimentary upgrades, and access to special events. You will also earn Membership Rewards points which can be redeemed for free flights and hotel stays.

Mastercard Black Card

The Mastercard Black Card comes with a hefty annual fee and no sign-up bonuses, but let me tell ya, its travel and dining rewards can really make up for that cost. However, it does have a downside—there are no transfer partners, which can be a bummer for some folks. Honestly, the Mastercard Black Card can be a tough nut to crack for these reasons. If you’re lookin’ for alternatives, consider the Platinum Card from American Express, which offers three times the points and a $200 airline fee credit. Or you might check out the Mastercard Reserve, which gives you a sign-up bonus of 60,000 points after you spend $5,000 in the first three months.

Now, if you’re thinkin’ about applying for the Mastercard Black Card, there are a few things you gotta meet. First up, you need an excellent credit score—740 or higher is a good starting point. You also gotta be a U.S. citizen and earn enough to cover that annual fee. While Barclays doesn’t publish specific income requirements for the Black Card, the higher your income, the better your chances of gettin’ approved. They’ll look at your credit history, income, and any potential debts, too. Oh, and don’t forget—you gotta be over eighteen and reside in the U.S.

While a credit score of 740 is solid, it ain’t the only thing they consider. Your income, credit score, and overall credit history all come into play when you’re applyin’ for that Mastercard Black Card.

Even though the Mastercard Black Card has a big annual fee, it does come with a lot of benefits and a pretty decent initial credit limit. The rewards program is top-notch compared to other cards in this class, but just be prepared to spend a bit more to get those perks. If you’re all about travel and dining rewards and can handle the costs, this card might just be worth it!

Dubai First Royale Mastercard:

It’s studded with a .235-carat diamond and trimmed with gold. This card is so exclusive that it’s reportedly offered only to royalty and extremely high net-worth individuals.

Isabella, International Art Dealer from New York City

“I’ve always been drawn to the finer things in life, and the Dubai First Royale Mastercard caught my eye with its diamond-encrusted card face and exclusive membership. It’s rumored to be the most difficult card to get, reserved for royalty and ultra-high-net-worth individuals. After years of curating my prestigious client list and proving my financial acumen, I was ecstatic to join the ranks of Royale cardholders. The personalized service and elite privileges have elevated my business dealings to a whole new level.”

Coutts Silk Credit Card

Only available to Coutts clients, this card is like having a golden key to the royal treasury, offering personalized service fit for a queen – because, well, it’s from the bank that the British Royal Family actually uses!

Sberbank Visa Infinite Gold Card

This isn’t just a credit card; it’s a statement piece, crafted from solid gold and adorned with diamonds and mother of pearl. It’s the kind of card that you casually drop on the table at dinner parties for that instant ‘wow’ factor.

Stratus Rewards Visa

It is also known as the “White Card.” This invitation-only gem is for those who have reached the pinnacle of success. With luxury travel benefits that’ll make you feel like a rockstar and a concierge service that answers your every whim, you’ll be living the high life in no time.

Ava, CEO of a Tech Startup from Seattle

“In the tech world, innovation and prestige go hand in hand. I wanted a credit card that not only offered great rewards but also had an element of prestige. The Stratus Rewards Visa, also known as the ‘White Card,’ was on my radar due to its ultra-exclusive nature. After my startup’s valuation soared, I was invited to apply for the card. Its rewards program, tailored to the needs of tech entrepreneurs like myself, has been incredibly beneficial for both my personal and professional life.”

Ethan, Hedge Fund Manager from London

“In the world of finance, having a prestigious credit card is a subtle signal of success. For me, the Stratus Rewards Visa card, or ‘White Card,’ was the ultimate status symbol. It’s invitation-only, catering to the wealthy and influential. After strategically positioning my fund and networking with current cardholders, I secured an invitation. The rewards, which include private jet access and luxury hotel upgrades, have been nothing short of extraordinary.”

Merrill Lynch Octave Black Card

It is exclusive, elite, and with a range of perks that’ll make your head spin. But brace yourself, because the entry requirements are as high as the rewards.

HSBC Premier World Elite MasterCard

It demands you to be part of the HSBC Premier club, which is like being in an international society of movers and shakers.

Diamond Card Visa Infinite

Tailored for those with a taste for the finer things in life, it offers travel perks that are just as dazzling as its gold and diamond-encrusted facade.

The Luxury Card™ Gold Card™

With a front dipped in 24K gold and a sturdy carbon back, this card not only looks like a million bucks but also treats you to a wealth of travel benefits.

Goldman Sachs Card

It is your ticket to the world of exclusive travel and concierge services. It’s like having a personal assistant in your pocket, ready to make your dreams come true.

The Palladium Card

Once the heavyweight of credit cards, its palladium and 23K gold composition was the ultimate status symbol.

Bank of America Accolades Card:

While it’s not an invitation-only card, the Accolades card is only available to Bank of America’s private banking clients.

These aren’t your average credit cards; they’re your VIP passes to the high life, and I’ve got the insider scoop on each one.

Statista.com reports:

Value of Credit on US Cards of $3.06 Trillion.

Number issued is 1.1 Million.

The number of Master Card users is 97 million.

The market size has been increasing a little every year:

2012 $905 Billion.

2014 $945 Billion.

2017 $1,044 Billion.

2019 $1,084 Billion.

Frequently asked questions (FAQs):

So, if I’m thinkin’ about snaggin’ a credit card and it’s lookin’ a bit tough to get, there are a few things that might be holdin’ me back:

-

High Credit Score Requirement: Some cards, especially the fancy ones with all the perks, are gonna want a high credit score to even consider me. If my score ain’t up to snuff, I might be sittin’ on the sidelines.

-

Strict Income and Employment Criteria: A lotta these cards have some serious income and job requirements. They wanna make sure I’ve got a stable financial background, which can make it tougher for folks like me who might not be rakin’ in the dough or have a shaky job situation.

-

Limited Availability: Some cards are exclusive for certain groups—like high rollers, frequent flyers, or members of specific clubs. If I don’t fit the bill, I might as well be whistlin’ in the wind.

Which Credit Cards Are Typically Considered Hard to Get?

Now, while the rules can change, here are some types of cards that are usually a real pain to get:

-

Premium Rewards Cards: These bad boys offer killer rewards and travel perks, but they come with high credit score and income requirements. If I’m not ready to play ball, I might be outta luck.

-

Luxury and Invitation-Only Cards: Some cards are aimed at the wealthy elite and are super exclusive. If I don’t get an invite, I can forget about it!

-

Co-Branded Cards with Prestigious Brands: Cards linked to high-end brands or organizations often have stricter approval standards, makin’ them a tough nut to crack.

What Can I Do to Increase My Chances of Getting a Hard-to-Get Credit Card?

If I’m dead set on gettin’ one of those elusive cards, here’s what I can do to boost my odds:

-

Build a Strong Credit History: I gotta pay my bills on time, keep my credit utilization low, and maintain a solid credit score. This shows lenders I’m a responsible spender.

-

Improve My Income and Employment Stability: If I can bump up my income and show I’ve got a steady job, I’ll look way more appealing to those credit card folks, especially for the high-end cards.

-

Start with Similar but More Accessible Cards: Maybe I should apply for cards that offer similar perks but with lower requirements. That way, I can build up my credit history before shootin’ for the big leagues.

Can I Apply for Multiple Credit Cards at Once to Increase My Chances?

Sure, I could apply for a bunch of credit cards at once, but honestly, it’s not the smartest move. Each application usually hits my credit report with a hard inquiry, which can drop my score for a bit. It’s way better to do my homework on the requirements for each card and pick the one that fits my financial situation best.

What Should I Do If I’m Denied for a Hard-to-Get Credit Card?

If I get denied for one of those tough cards, no need to freak out. Here’s my game plan:

-

-

Review the Denial Letter: I should check out what the issuer says about why I got the boot.

-

Work on Improving My Creditworthiness: I can take care of any issues mentioned in that denial letter, like payin’ off debts or fixin’ any errors on my credit report.

-

Consider More Attainable Cards: I might wanna look at credit cards that are more within my reach for now. I can build my way up to those exclusive options as I improve my credit game.

-

https://creditrewardperks.com/how-i-got-800-credit/

A score in the top 10% would generally be around 830 or higher would get you one of these for sure. This is considered an “exceptional” score under the FICO model, which means that borrowers with these scores are at the top of the credit food chain. They are likely to receive the most favorable interest rates and terms when borrowing money.

Here’s a rough breakdown of the FICO score ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Exceptional

A credit score within the top 20% would likely fall within the “Very Good” to “Exceptional” range according to the FICO model, which is approximately 740 and above.

Alternatives: Easiest Credit Cards to Get and How I Got Them

Here’s a rundown of some of the easiest cards to snag and how I managed to get a few of them myself.

1. Chase Freedom Rise

Overview: This card is perfect for those looking to earn cash back on everyday purchases, and it’s relatively easy to qualify for.

How I Got It:

- Established Credit History: I made sure to have a solid credit history, even if it was short. I started with a couple of secured cards to build my score before applying.

- Responsible Use: I used my existing credit cards responsibly, ensuring I paid off my balance each month to keep my utilization low.

2. Chime Credit Builder Visa

Overview: This is a secured card that helps you build credit while managing your spending.

How I Got It:

- Opened a Chime Account: I signed up for a Chime account, which was super easy. The credit builder card is linked to my Chime spending account.

- Deposited Funds: I deposited money into my Chime account to use as my credit limit, making it a low-risk way to build my credit.

3. U.S. Bank Altitude

Overview: This card offers rewards for travel and dining, and it’s fairly accessible for those with good credit.

How I Got It:

- Good Credit Score: I made sure my credit score was above 670 before applying. I checked my credit report for any inaccuracies and cleaned it up.

- Regular Income: I highlighted my stable income on the application, which helped bolster my chances of approval.

4. Capital One SavorOne Student

Overview: This card is designed for students and offers great rewards on dining and entertainment.

How I Got It:

- Student Status: As a college student, I applied with my student ID and proof of enrollment, which made it easier to qualify.

- Minimal Credit History: I had a couple of small student loans, which helped establish my credit history, even if it was limited.

5. OpenSky® Plus Secured Visa

Overview: This is a secured credit card that helps build credit without a credit check.

How I Got It:

- Secured Deposit: I made a small deposit to secure my credit limit. This card doesn’t require a credit check, making it super accessible.

- Consistent Payments: I committed to making on-time payments to build my credit score.

6. Any Secured Card

Overview: Secured cards are generally easier to get since they require a cash deposit as collateral.

How I Got It:

- Researching Options: I compared several secured cards and chose one with a low annual fee and good terms.

- Making Regular Payments: I used the card for small purchases and paid it off each month to build my credit.

7. Discover it® Student

Overview: This student card offers cash back and is designed to help students build their credit.

How I Got It:

- Student Benefits: I applied as a student and highlighted my income from a part-time job.

- Cash Back Rewards: I was drawn to the rewards program, which helped me stay motivated to use the card responsibly.

8. Prosper Card

Overview: This card is designed for those looking to build credit, and it’s relatively easy to qualify for.

How I Got It:

- Low Credit Score Acceptance: I applied knowing they accept lower credit scores, which worked in my favor.

- Using Responsibly: I kept my utilization low and made timely payments to boost my score.

9. Capital One Platinum

Overview: This card is aimed at those looking to build or rebuild their credit.

How I Got It:

- Pre-Approval: I checked for pre-approval offers on Capital One’s website, which helped me gauge my chances.

- Solid Payment History: I made sure my other accounts were in good standing before applying.

10. Petal 2 Card

Overview: This card is great for those with no credit history, as it uses alternative data for approval.

How I Got It:

- No Credit History Needed: I applied knowing that Petal looks at my banking history instead of just my credit score.

- Responsible Banking: I maintained a good banking history with consistent deposits.

11. Indigo Mastercard

Overview: This card is designed for those looking to rebuild their credit.

How I Got It:

- Flexible Approval: I applied knowing that they accept a range of credit scores.

- Utilization Awareness: I kept my credit utilization low on other accounts to improve my chances.

12. Fingerhut

Overview: This is more of a retail card, but it’s great for building credit with smaller purchases.

How I Got It:

- Easy Approval: I applied online and was approved quickly, even with a lower credit score.

- Small Purchases: I made small purchases and paid them off to build my credit history.

13. FIT Platinum Mastercard

Overview: This card is aimed at those looking to build or rebuild their credit.

How I Got It:

- Low Barriers to Entry: I applied knowing they have lenient approval standards.

- Timely Payments: I committed to making payments on time to establish my credit.

14. Aspire Credit Card Rewards

Overview: This card offers rewards and is designed for those with fair credit.

How I Got It:

- Researching Options: I looked for cards that cater to those with fair credit and found this one.

- Responsible Use: I used it for everyday purchases and paid it off monthly.

15. Chime

Overview: Chime offers a spending account with a credit builder feature.

How I Got It:

- Opened a Chime Account: I signed up for Chime and utilized the credit builder feature to manage my spending and build credit.

16. First Progress Select Card

Overview: This is a secured card that helps build credit with a low deposit.

How I Got It:

- Secured Deposit: I made a small deposit to secure my credit limit.

- Timely Payments: I made sure to pay off my balance each month to improve my credit score.

17. Chase Sapphire Preferred

Overview: This card is a bit more challenging but still accessible for those with good credit.

How I Got It:

- Strong Credit Profile: I maintained a credit score above 700 and had a solid income.

- Researching Benefits: I was drawn to the rewards and benefits, which motivated me to apply.

18. Citi Double Cash Card

Overview: This card offers cash back on all purchases and is fairly easy to qualify for.

How I Got It:

- Good Credit History: I ensured my credit score was in good standing before applying.

- Cash Back Motivation: The cash back rewards were a big draw, so I was eager to use it responsibly.

19. Chase Freedom Unlimited

Overview: This card offers unlimited cash back and is accessible for many applicants.

How I Got It:

- Application Timing: I applied at a time when my credit score was at its peak, which helped my chances.

- Utilization Management: I kept my credit utilization low on existing cards to improve my application.

![Benefits of REI Credit Card [Bonus and Cash Back Dividends]](https://creditrewardperks.com/wp-content/uploads/2022/04/shutterstock_10564236501b.jpg)

I tried to get these but failed, probably because too many apps set a flag.

Citi Prestige Card

Wells Fargo Propel American Express Card

American Express Platinum Card

Bank of America Premium Rewards Credit Card

Citi Double Cash Card

Chase Freedom Flex

Alaska Airlines Visa Signature

Capital One SavorOne

I got the capone ventura card on first app. I could prob get the amex but they do not allow carry balance so I am not interested. Do you have a list of easy to get cards?

I was declined for the better cards, so I got a discover secured, that solved my immediate problem of not been able to rent a car. I got a $300 limit that was slowly increased and now to $1k. A funny thing happened a year later I started getting offers in the mail. They offer you credit when you do not need it, lol. If you seem poor and needy then you are denied.

Here are some of the easiest to get:

Chase Freedom Rise

Chime Credit Builder Visa

U.S. Bank Altitude

Capital One SavorOne Student

Opensky plus sec visa

any secured card

Discover it Student

Prosper Card

Capone Platinum

Petal 2 Card

indigo Mastercard

Fingerhut

FIT Plat MC

Aspire CB rewards

Chime

First Progress Select Card

Chase Sapphire Preferred

citi doublecash

Chase Freedom Unlimited

It is reasonably easy to get a secured card. I got one, but the limit was so low, like 300. All I can use it for is gas and some snacks. I can attest that many merchants take debitcards so you have options.

I learned that amex black requires net worth of 16M. So I guess I will not bother. I was able to get the amexgold card with by measly salary.

Who has that kind of money? I can barely make rent. Some of the cards you mentioned I have never heard of. Anyway thanks for the post.

I was not approved for Centurion and my score is 820. I think you need high income and some connections. I always want what I can not get. I’d love to have the black one. I have never seen one. Some on this list I have not heard of, thank you for that.

xoxo

Why not just the the regular amex? I had one for years, it works fine. I also have a visa as a backup. I guess if you travel alot there are some perks. I use mine for everyday items for quick checkout because you do not have to wait for change and all of that.

Why are you chasing out of your league?

Just get a normal and stop trying to be rich.

You still have to pay for stuff, a card gives you a few weeks until bill arrives.

Paying 20% interest is a fast way to poor house. One of my cards is even higher, like 29%, outrageous. My advice, pay cash, use debit card, have on cc.

I did some research and found:

You need a high income, but they do not verify.

The amex black is for rich people only, that spend over $25k per month.

The JP reserve card is very hard to get, you need over $10 million net worth.

City world elite, is attainable, with $80k income and 750 score.

Chase SR is not that difficult to get. If you have a job and 720 score.

The platinum amex is pretty good. I first got the regular green card, and a year later they started sending me upgrade offers. The annual fee is kinda high. I guess it is worth it if you travel alot.

I arrived in Salt Lake City, I used my Amex Platinum to book a rental car. It was a breeze. I was able to take advantage of the Fine Hotels & Resorts program. I received complimentary breakfast for two and a room upgrade. Note that you have to ask if they have any upgrades available.