What’s a Variable Credit Card Interest Rate?

You’ve likely heard of it, but how do you calculate it?

There are many factors that can affect the interest rate on a card, and the issuers will usually outline the calculation process in the card’s terms and conditions. Keep reading to learn how the interest rate on a credit card works and how you can calculate it on your own.

Variable Rates

I opened my credit card statement and noticed that my interest rate had gone up. As a diligent cardholder, I prided myself on keeping a close eye on my finances, so seeing that my APR had not only increased but also varied caught me off guard. The new rate was 25%, Ouch.

I was sitting at my kitchen table, a sturdy maple piece that had been the backdrop for many budget reviews and financial planning sessions. The statement lay before me, the numbers printed in that all-too-familiar font, but this time they told a different story. The interest rate, which I had locked in at a competitive fixed rate when I first signed up for the card, had shifted to a variable rate, now sitting at a few percentage points higher than before.

The credit card was my go-to for purchases that I intended to pay off quickly, taking advantage of the rewards program without accruing much interest. But with this new variable rate, I knew that carrying a balance could become significantly more costly.

I remember feeling a mix of confusion and frustration as I tried to make sense of it all. I had always been careful to read the fine print, to understand the terms and conditions of my credit card agreement. Yet here I was, facing an unexpected change that could potentially impact my financial strategy.

Determined to get to the bottom of it, I pulled out my laptop, which was already warm from a morning of use, and began researching. I learned that many credit card issuers reserve the right to switch from a fixed to a variable interest rate, especially if there are changes in the market or if the cardholder’s creditworthiness takes a hit.

I also discovered that the variable rate was tied to an index, such as the prime rate, which meant that my interest charges could fluctuate with the broader economic landscape. This variability added an element of unpredictability to my financial planning, something I wasn’t entirely comfortable with.

If you have several debts, it can be hard to choose which to pay first. It’s usually wiser to focus on the debt with the highest interest rate, such as a credit card. Similarly, it’s much more prudent to pay off credit card debt than to owe money on a car loan. In addition to reducing your monthly payments, removing variable credit card debt can improve your credit score.

Variable APRs are tied to an index, usually the prime rate, which follows the interest rates set by the Federal Reserve, a central bank in the United States. Since the Prime Rate varies, so will the interest rates on your credit card. To make sure you know when your rate will change, check your statement every month, and get email alerts. If you don’t receive a notice of the change, you may have missed the opportunity to negotiate with your credit card issuer.

Variable credit cards have one major drawback: they don’t notify you of interest rate changes. The credit card issuer sets the interest rate on these cards, and it’s assumed that these changes will occur often. This is a big disadvantage, but you can still exert some control over the rate by making payments during your grace period. And remember, paying your bill in full every month is the best way to avoid interest charges.

Unlike fixed credit cards, variable credit card interest rates change with the underlying market index. This means that your repayment plan will change over time, and the interest rate may be lower in some points than in others. While fixed APR offers stability and security, it may increase your interest payments in the long run. And if you have poor payment history or a bad credit score, your interest rates may increase as well. This is why it’s important to understand the differences between a fixed and variable credit card interest rate.

A variable rate card interest rates will vary with the prime rate.

Each bank has its own prime rate and use it to set loan rates.

The average credit card has a rate 13% over the prime rate.

Here is how it changes over time:

Date in Effect Rate

22-Sep-2022 6.25%

May 5, 2022 4.0%

March 17, 2022 3.5%

March 16, 2020 3.25%

March 4, 2020 4.25%

Oct. 31, 2019 4.75%

Sept. 19, 2019 5%

Aug. 1, 2019 5.25%

Dec. 20, 2018 5.5%

Sept. 27, 2018 5.25%

June 14, 2018 5%

March 22, 2018 4.75%

Dec. 14, 2017 4.5%

June 15, 2017 4.25%

March 16, 2017 4%

15-Dec-2016 3.75%

17-Dec-2015 3.50%

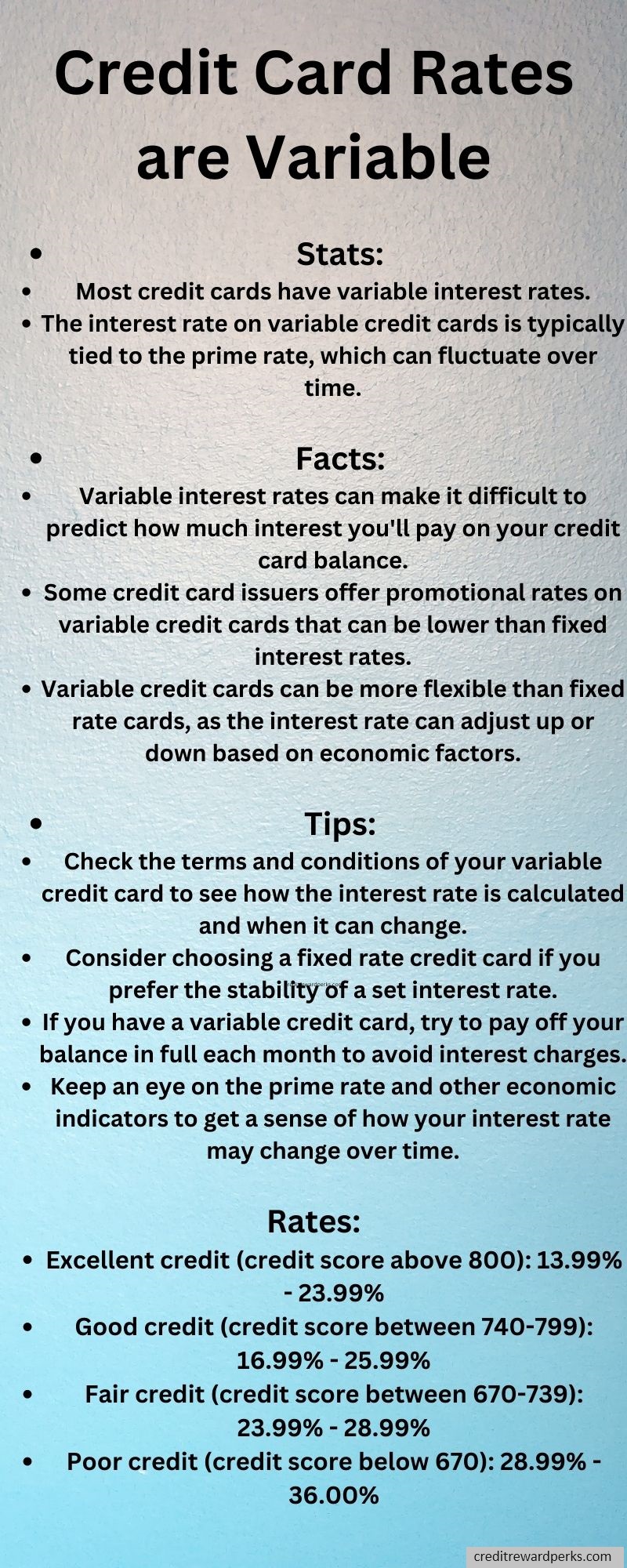

Rates vary by type of card, for example:

Travel reward cards, 19.3%

Airlines, 20.1%

Secured, 22.3%

Cashback, 18.8%

Student, 18.9%

Hotel, 19.8%

Cash advance, 30%

Average rates by credit score in 2020:

Super Prime (720+)

17%

Prime (660 – 719)

21%

Near Prime (620 – 659)

22.5%

Subprime (580 – 619)

23%

Deep Subprime (579 or lower)

24%

Overall

19.2%

I had a rate of 13 percent in 2020, but now it is up to 19 percent, I think because of fed rate hikes. I keep a low or zero balance so does not make much diff to me.

FAQ

1. What is a variable interest rate on a credit card?

A variable interest rate is a credit card rate that changes based on another interest rate, typically the Prime Rate. It’s like a chameleon, changing its colors based on its environment. If the Prime Rate goes up, your interest rate might also climb. If it goes down, your rate might decrease. Or it might just stay the same and leave you guessing.

2. How is the variable rate determined?

The variable rate is usually the Prime Rate plus a certain percentage that represents the lender’s assessment of your credit risk. It’s a bit like a chef’s secret recipe, with the Prime Rate as the main ingredient and your creditworthiness as the seasoning.

3. Will my variable interest rate change every month?

Not necessarily. While the Prime Rate can change from month to month, your variable interest rate won’t always follow suit. It depends on the terms of your credit card agreement. Sometimes, it may feel like you’re trying to predict the weather – it could stay sunny, or a storm could roll in!

4. How will I know if my variable interest rate changes?

Your credit card issuer is required to inform you of any changes to your interest rate. This could be through a letter, an email, or an update to your online account. So keep an eye on your mailbox, both digital and physical!

5. How can I lower my variable interest rate?

Improving your credit score is one way to potentially lower your variable interest rate. It’s like sprucing up your garden to impress the neighbors. The better your financial “garden,” the more likely lenders are to offer you favorable rates.

6. Can I switch from a variable interest rate to a fixed one?

It depends on your credit card issuer. Some might allow you to switch, but others may not. It’s worth asking, though! It’s like asking for extra fries at a restaurant – the worst they can say is no!

7. Does a variable interest rate mean my minimum payment will change?

Possibly, yes. If your interest rate goes up, the finance charges on your balance will increase too. That could lead to a higher minimum payment. It’s a bit like if your favorite coffee shop raises prices – your regular order is going to cost you more.

8. Is a credit card with a variable interest rate a bad idea?

Not necessarily. While variable interest rates can go up, they can also go down. Plus, credit cards with variable rates often start with lower APRs than their fixed-rate counterparts. It’s kind of like choosing between a roller coaster and a merry-go-round: the roller coaster has more ups and downs, but also more thrills!

9. Are variable rates only for credit cards?

No, variable rates can be found in all kinds of lending products, like mortgages, student loans, and car loans. They get around, like that friend who always seems to be on a trip to some exciting destination.

10. Can I negotiate a lower variable rate with my credit card company?

Believe it or not, you can actually try! If you’ve been a good customer (i.e., paying on time, not maxing out your credit), there’s a chance your credit card issuer might consider lowering your interest rate. It’s like asking for an extra scoop of ice cream – you might just get it!

Fixed

Unlike variable credit cards, where the interest rate changes according to the prime index, a fixed card’s interest rate stays constant throughout the life of the card. However, this stability comes with a price. While fixed cards don’t fluctuate as often, they may have higher interest rates than their variable counterparts. While the fixed rate is stable, it can still change due to other factors, such as inflation or missed payments.

Most credit cards that American consumers own are variable rate cards, which means that the APR fluctuates with an index, such as the prime rate. And since the prime rate is subject to fluctuations, the APR will rise as well. But with a fixed credit card, you don’t have to worry about your interest rate soaring when the prime rate increases. And because you’ll know the exact rate, you can budget accordingly.

As long as you have a high credit score, you’ll be able to qualify for a lower interest rate. If your debt-to-income ratio is less than 50%, then you’re more likely to qualify for a lower interest rate. A variable rate will be noted with a V next to it. Many credit cards come with fixed rates, but some are issued by credit unions. There are a number of reasons for this.

Credit card interest rates are higher than average, but fixed-rate cards often come with lower rates than variable cards. Fixed-rate credit cards, for example, tend to be lower than variable rates, which is an excellent reason to consider a fixed-rate card. Many credit unions offer low-interest cards to their members, which is a valuable benefit for both parties. A fixed-rate card also gives you more flexibility when making purchases.

Penalty

Late payment penalties are costly and can drive up the interest rate on your credit card. Late payment fees, also called penalty rates, are a percentage of the balance owed, which can increase your overall debt. A few popular credit cards do not charge late fees, but they can hike interest rates after two months of nonpayment. It is advisable to pay the minimum amount due each month to avoid incurring late fees. In addition to late fees, credit card companies also charge a late payment fee, which can be as much as six percent of the balance.

While a late payment can have disastrous consequences, it is often necessary to avoid a penalty APR. Late payments can result in a higher interest rate, and a penalty APR will essentially double your interest rate. Depending on the credit card company, the interest rate can be as high as 27 percent, so it’s important to pay on time to avoid paying a higher rate. A late payment can also result in your account being closed.

The best way to avoid a penalty APR is to make your minimum payments on time every month. This will ensure that you stay within your credit limit. You can also contact the credit card issuer to request a reduction in the penalty APR. However, be aware that this approach doesn’t guarantee a reduction. In some cases, you may be asked to make six on-time payments before your penalty APR is removed.

While the penalty APR cannot increase during your first year with the credit card, it can increase if you fail to make payments on time. Even if you pay your bills on time, the penalty APR may stay in place. Your interest rate may even increase over time as the issuer sees fit. This penalty APR may cost you hundreds of dollars in a short period of time. If you do, you’ll lose your promotional offers.

Calculate

In order to calculate the interest rate on a credit card, you must know the term “annual percentage rate”. It is generally expressed as a percentage, and is the sum of the interest rates charged on all balances for a given period. You can also find out the annual percentage rate by multiplying the total balance of the credit card by the number of days in the billing cycle. By knowing the term “annual percentage rate,” you will be able to understand the interest rate on a card.

APR stands for annual percentage rate. This is the interest rate charged on the unpaid balance on a credit card. The interest rate can be calculated in many ways, including daily, weekly, or monthly payments. For example, if you have multiple credit cards and make the minimum payments on all of them, you can enter a different amount for each. The calculator will then calculate the interest paid on those cards. The interest rate is not the same as the interest rate on a credit card with a high interest rate.

Interest is calculated using a formula that banks use to calculate the rate. Some credit card issuers calculate the interest on a daily basis and divide it by the number of days in a billing period. However, you must know that the interest rate applied to your balance will affect your budget. To find out your interest rate, first understand how credit cards work. Some credit card companies charge interest based on the average balance of the account, while others calculate it based on the average daily balance.

especially if you replace them with a series of on-time payments.

Credit Cards For Outdoors

Midas Credit Card

REI

Hardest To Get

Discover Iridescent

American Express Platinum Vs. Black Cards

Grace period

A grace period is a legal period of time when interest is not charged on any purchases or balance transfers. This grace period is often referred to as the ‘floating’ period. If your credit card interest rate is zero, the grace period is applicable to purchases only. However, if you have an outstanding balance on your card, interest will start accruing the day you make a purchase or transfer a balance.

Once the balance is paid in full, most credit card issuers restore the grace period. The only exceptions to this are balance transfers and cash advances. During the grace period, you’ll not pay interest, but you’ll start accruing interest from the date of the transaction. However, you can still take advantage of 0% balance transfer offers to pay off your purchases without interest. In this case, the purchase or balance transfer is on June 6, and the payment due date is June 30. However, the payment date for this transaction is June 30, and it’s in the next billing cycle.

The grace period on your credit card can be a tricky concept to understand. However, a good way to make the most of it is to make sure that you pay off the balance in full before the next billing cycle. In essence, this is free money that the credit card company is giving to you. If you pay your balance off in full by the due date, the grace period will extend and the interest rate will remain low.

While it is not legal for credit card issuers to offer a grace period, most of them do. In fact, some of them will opt to omit the grace period altogether. This is especially true for expensive subprime credit cards that are targeted at people with bad credit. While you’ll be able to save a few dollars by paying the minimum amount, you’ll still be liable for the interest on the balance if you don’t pay on time.

Credit card rates and Federal bond rates differences.

Credit Card Rates:

Credit card rates refer to the interest rates charged by credit card companies on the balances you carry from month to month. When you use a credit card to make purchases or take cash advances, you essentially borrow money from the credit card issuer. If you don’t pay off the full balance by the due date, you begin to accrue interest on the remaining amount.

Credit card rates are typically higher than other forms of borrowing because they are unsecured debt, meaning there is no collateral involved. Since credit card issuers take on more risk by lending money without any assets to seize if the borrower defaults, they charge higher interest rates to compensate for that risk. The specific rate you receive on your credit card will depend on factors such as your credit score, credit history, and the terms of the specific credit card issuer.

For example, let’s say you have a credit card with an outstanding balance of $1,000 and an annual interest rate of 18%. If you only make the minimum payment each month, let’s assume it’s 2% of the balance, it would take you several years to pay off the debt, and you would end up paying significantly more than the original $1,000 due to the interest charges.

Federal Bond Rates:

On the other hand, Federal bond rates, also known as Treasury bond rates or government bond rates, represent the interest rates on debt issued by the United States government. The U.S. Treasury Department issues various types of bonds to finance government spending and manage the national debt. These bonds are considered low-risk investments because they are backed by the full faith and credit of the U.S. government.

Federal bond rates serve as a benchmark for interest rates in the economy because they are widely regarded as safe investments. Other interest rates, including mortgage rates, corporate bond rates, and even credit card rates, are influenced by changes in Federal bond rates.

For example, if the U.S. Treasury offers a 10-year Treasury bond with an interest rate of 3%, other lenders and borrowers in the market may adjust their rates accordingly. Mortgage rates might increase slightly, and credit card issuers could also adjust their rates based on market conditions and other factors.

Note that while Federal bond rates can influence credit card rates, they do not directly determine them. Credit card rates are influenced by a variety of factors, including market conditions, the prime rate (the rate at which banks lend to their most creditworthy customers), and individual creditworthiness. Therefore, changes in Federal bond rates may indirectly impact credit card rates, but they are not the sole determining factor.