I found some ways to improve my score.

Key Takeaways:

- Manage your bill payments effectively by staying organized and avoiding late payments.

- Aim for a credit utilization ratio of 30% or less to positively impact your credit score.

- Avoid frequent requests for new credit to prevent negative effects on your credit score.

- Build credit history by establishing credit accounts, such as secured credit cards or credit builder loans.

Factors that affect your credit score

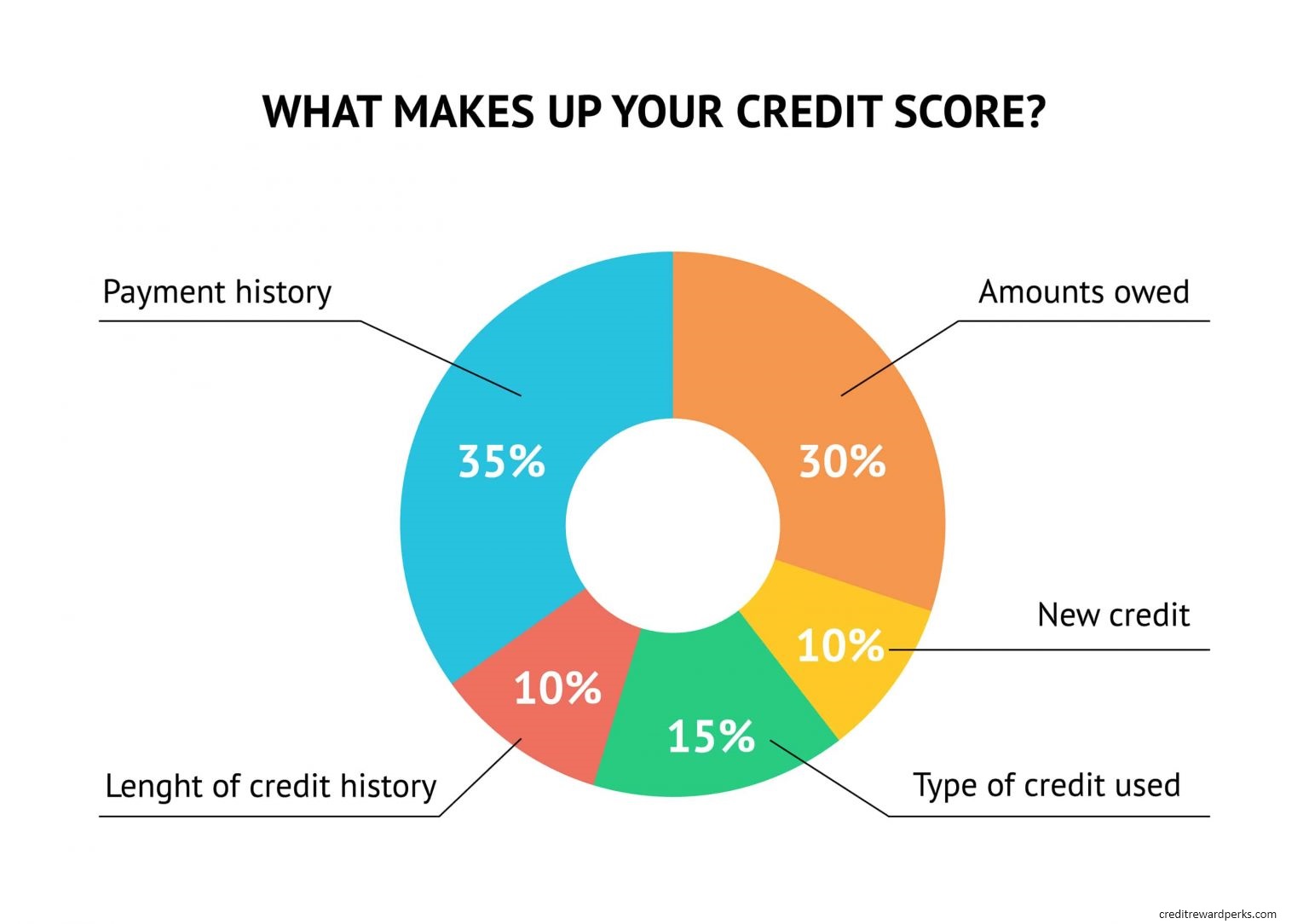

The payment history is one of the most important elements in your credit score, accounting for up to 35% of your total score. Missed payments will lower your score, since lenders want to make sure you can pay off any debt. A payment history with several late payments will lower your score more than one late payment with no pattern. However, a late payment does not necessarily mean that you will be turned down. If you have been late on at least two or three payments in a row, this may not be as damaging as it might sound.

- Payment History (35%): This is the most influential factor. It includes your track record of making timely payments on all your debts, such as credit cards, loans, and mortgages. Late or missed payments can negatively affect your score big time.

- Credit Utilization Ratio (30%): This is the ratio of your total outstanding balances on your credit cards to your total available credit. A lower ratio is better. High utilization can be a signal that you’re overly reliant on credit and may have trouble paying off what you owe.

- Length of Credit History (15%): This includes the average age of your credit accounts and the age of your oldest account. Lenders prefer to see a longer credit history because it gives them more information about your behavior as a borrower.

- New Credit Inquiries (10%): This refers to the number of new credit applications you’ve made recently. Each application results in a “hard inquiry” on your credit report, which can lower your score. However, several inquiries of the same type within a short period (like for a mortgage or car loan) typically count as a single inquiry.

- Credit Mix (10%): This looks at the different types of credit you have, such as credit cards, student loans, car loans, and a mortgage. A diverse mix can show lenders that you can handle different types of credit responsibly, but it’s not necessary to have one of each!

My credit score was sitting at 690, which was decent, but I knew it wasn’t quite enough to secure a loan for the boat I had my eye on. I had a specific model in mind, a sleek vessel with a 205 horsepower engine that promised countless adventures on the water. So, I set a goal to reach a credit score of 730, a number that would unlock better interest rates and make my dream more financially feasible.

I started by scrutinizing my credit report, looking for any inaccuracies that could be dragging down my score. To my relief, everything was accurate, so I moved on to the next step: reducing my credit utilization. I had a couple of credit cards that were teetering close to their limits, which I learned could be a red flag to lenders. Over the next few months, I tightened my budget and paid down those balances, always ensuring I kept the utilization below 30%.

Punctuality became my mantra as I meticulously made sure every bill was paid on time. I set up automatic payments for my existing debts and kept a close eye on due dates. Even a single late payment could set me back, and I wasn’t about to let that happen.

As I worked on these strategies, I watched my credit score like a hawk. Every point increase was a victory, a step closer to the open waters and the freedom of the fishing boat that awaited me. I refrained from opening any new credit accounts during this period, as I had learned that too many hard inquiries could be detrimental to my credit health.

After several months of disciplined financial management, the moment of truth arrived. I logged into my credit monitoring app and held my breath as the score updated. There it was, in clear, bold digits: 730. I had done it.

With my improved credit score in hand, I confidently walked into the bank to apply for a fishing boat loan. The loan officer reviewed my application and, after a short wait that felt like an eternity, came back with good news. I was approved, and not only that, but the interest rate of 7% was more favorable than I had dared to hope for.

The day I took out the loan was a milestone in my life. I signed the papers with a steady hand, knowing that I was not only about to become the owner of a beautiful fishing boat but also that I had taken control of my financial future.

The boat itself was a thing of beauty, 22 feet in length with a glossy fiberglass hull that cut through the water with grace and ease. The engine hummed with power, and every time I took it out on the lake, I felt a sense of accomplishment wash over me.

The use of credit accounts is another important factor to keep in mind. One way to improve your credit health fast is to keep your usage to a minimum. Avoid maxing out your credit cards or using them for major purchases. Leaving some of the balance unpaid will raise your utilization rate, so keep it to a minimum. Credit card use accounts for 30% of your overall score. However, this number can vary. If you’re concerned about the impact on your credit score, consider lowering your debt to limit ratio.

High credit card balances also affect your credit score negatively. Having a high credit card balance may signal that you’re at risk of defaulting on your loan. A lower credit utilization ratio is preferable to a higher debt to credit ratio. However, too many credit cards near your limit will have a negative impact on your credit score. This can mean that you have too much debt. Therefore, it’s important to avoid carrying more than 30% of your credit. Check out this guide to learn more.

On-time payment is another important factor. Lenders prefer to see customers who consistently pay their bills on time. The more on-time payments you make, the more likely they are to be able to trust you with their money. On-time payment is important in credit scoring, so try to pay off any past bills on time. You can schedule automatic payments so you are always on time. Lastly, too many different types of credit accounts will affect your credit score negatively.

American Express reported the following score by income:

- $30k or less: 590

- $30k to $50k: 643

- $50k to $75k: 737

infographic

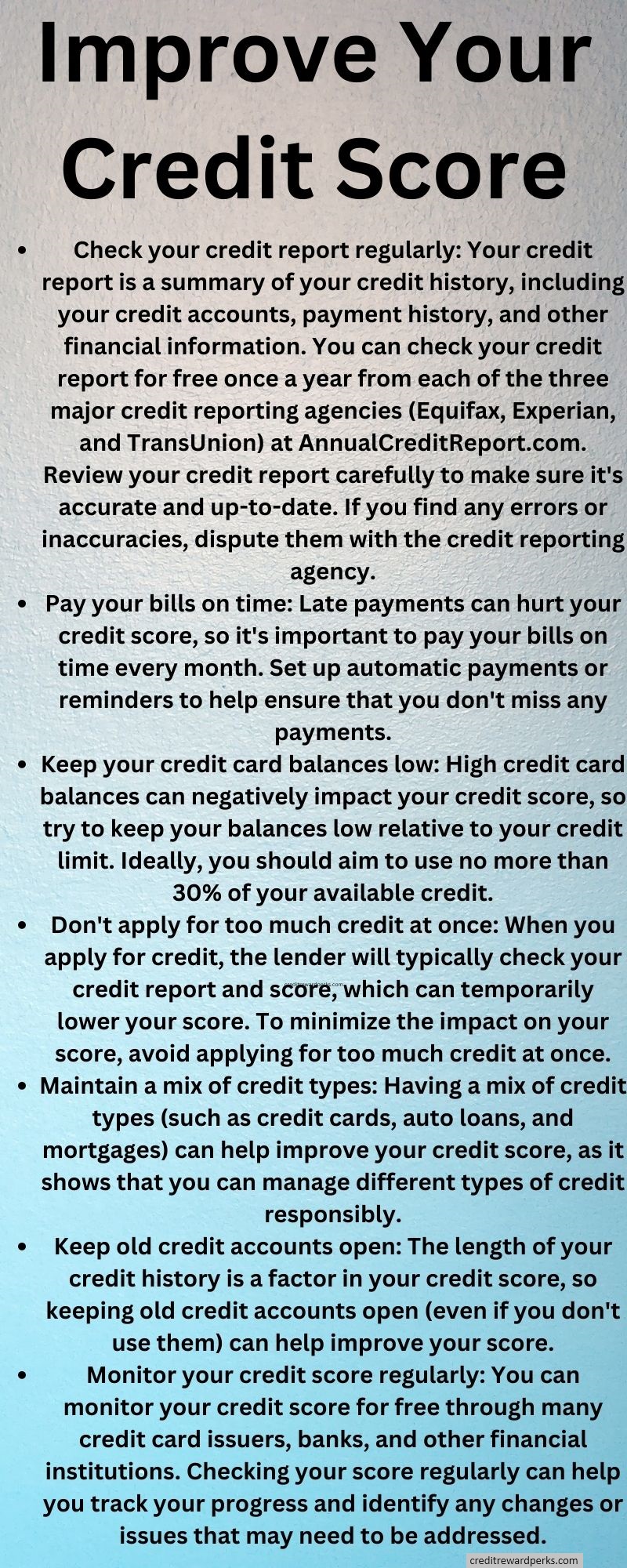

Ways to improve your credit score

Paying down revolving debt is one of the best ways to improve your score. This factor directly affects your credit score and affects the amount of credit you owe. The best strategy is to make the largest payment on the highest interest card first and then make minimum payments on the other cards. You can also set up an alert so you’ll get a notification if your balance reaches a certain amount.

Adding authorized users to your accounts is a great way to improve your credit score. Unfortunately, not all credit card issuers allow this. However, if you have low credit limits or a short credit history, adding an authorized user can make a huge difference. While adding an authorized user means that you are jointly responsible for payments on the card, any missed payments will show up on your authorized user’s credit report.

Paying your bills on time is another great way to improve your credit score. Regardless of whether you are a student, a high credit score is still important to your future. Making your payments on time will help you establish a positive payment history, and delinquent payments will gradually fade away. You can even set up automatic payments in your bank account. And while you’re rebuilding your credit, don’t forget to pay off your credit cards!

The number of available credit is the second most important factor in your credit score. While a low score is better than one with no credit cards or loans, it’s still better to have many available lines of credit than none at all. This is because there is less room for errors. Moreover, a higher score indicates you are less likely to fall behind on payments. And as long as you maintain good payment records, this is the key to a high credit score.

Another crucial factor in your credit score is your credit utilization ratio. Your credit utilization ratio (CUR) is the percentage of your available credit that you’re currently using. Aim for a low utilization rate of less than 30% for each of your credit accounts. In general, it’s best to maintain balances at 10% or lower. That’s better than a high utilization of 30%. But you can always pay off those balances to improve your credit score.

Here is an in-depth guide from Money.com

Infographic

Infographic

Cost of a high credit score

The costs of bad credit are many and often unavoidable. They increase the cost of borrowing by charging you higher interest rates, which are the lender’s way of protecting themselves. With no credit or a low score, you’ll pay more interest on all loans, including your home and college loans. You’ll also end up paying inflated prices on payment plans. Here’s how to save money while improving your credit score.

A good credit score can save you hundreds of thousands of dollars over your lifetime. Because people with good credit are viewed as lower risks by lenders, they pay lower interest rates. Bad credit can affect your ability to rent housing or obtain car loans or life insurance. A higher credit score can lead to better rates on all of these purchases. If you have bad credit, it may also hinder your ability to purchase a home. You may be able to find a cheaper mortgage or rent a cheaper home, but you’ll likely have to pay higher interest rates for these types of loans.

If you don’t have good credit, you might not be eligible for cell phone contracts. You may have to pay extra for up-front costs, such as a security deposit. You may be required to pay for a higher-end phone than you can afford. However, you may be able to obtain a better-than-average job without a security deposit. You can also sign a contract with a major company and save on monthly payments.

Another way to improve your credit score is to add another credit card. Credit card companies often penalize consumers who max out one card. Asking them to raise their credit limit will reduce your utilization. Although applying for a loan for a mortgage or auto loan does not damage your score, too many inquiries hurt your score. If you can pay off your balance in full each month, your credit score will appreciate. Aim for a lower utilization of your credit cards.

Getting a copy of your credit report

If you are thinking about applying for a loan or renting an apartment, you will want to check your credit report for any errors or suspicious activity. Creditors use credit reports to make decisions about you, and it’s important to know how to dispute inaccurate information. You can also check your credit report for mistakes by contacting the credit bureaus directly. The Federal Trade Commission (FTC) has sample letters to write and information on how to file a dispute.

Your credit report includes details of all your open and closed accounts. It also contains information on who has requested your report in the past six months. It will also show you any accounts that were passed to collection agencies. Your report also includes information from public records, including any debt or payment issues you may have had. To avoid identity theft, it’s important to keep track of your credit report. Try to get a copy at least once a year, and before applying for a loan or insurance. If you discover any errors, contact the credit bureaus or the business that provided the information.

Your credit score is calculated from the information in your credit report. It is calculated by plugging in your debt history, credit accounts, and any bankruptcy information. While your score may differ from one company to the next, the federal law provides you with a free copy of your report every 12 months. To make sure you’re not paying more than you’re supposed to, you should consider getting a copy of your credit report and credit score each year.

Getting a copy of your credit report is crucial if you’re denied credit. If you’ve received a notice from a creditor, you have the right to request a copy of your report. If you find errors in your report, contact the company that reported them. The information could be fraudulent. Regardless of the reason for the disputed information, the free copy of your report will help you identify the perpetrator.

Reviewing Your Credit Reports

One of the first steps in improving your credit score is reviewing your credit reports from the major credit bureaus. These reports hold vital information about your credit history, including any late payments, outstanding debts, or inaccuracies that may be affecting your score.

By carefully reviewing these reports, you can identify any errors or discrepancies that might be negatively impacting your credit score. Look out for any accounts that you don’t recognize, incorrect payment information, or outdated personal details. Keep in mind that even small errors can have a significant impact on your creditworthiness.

To simplify the process, you can request a free copy of your credit reports from each of the three major credit bureaus – Experian, TransUnion, and Equifax – once a year. Take the time to carefully go through each report, and if you find any inaccuracies, be sure to dispute them with the respective credit bureau to have them corrected.

| Credit Bureau | Website | Contact Number |

|---|---|---|

| Experian | www.experian.com | 1-888-397-3742 |

| TransUnion | www.transunion.com | 1-800-916-8800 |

| Equifax | www.equifax.com | 1-800-685-1111 |

Remember, reviewing your credit reports regularly is essential to ensure the accuracy of your credit information and take necessary steps to improve your credit score.

Getting a Handle on Bill Payments

Timely bill payments play a crucial role in improving your credit score. By getting a handle on your bill payments, you can avoid late fees, prevent negative marks on your credit report, and demonstrate responsible financial behavior.

One effective strategy is to create a monthly budget that includes all your bills, along with their due dates. This will help you stay organized and ensure that you never miss a payment. Consider setting up automatic payments or reminders through your online banking platform to stay on top of your bills. My bank allow automatic payments to be setup months in advance so I do that.

In addition, it’s important to prioritize your bill payments. Start by paying off high-interest debts first, such as credit cards, to minimize interest charges and reduce your overall debt load. By tackling these debts, you’ll free up more money to allocate towards other bills.

Limit Requests for New Credit

Every time you apply for new credit, it triggers a hard inquiry, which can temporarily lower your credit score. To improve your credit score, it’s crucial to limit unnecessary requests for new credit and only apply when necessary.

When considering new credit, take the time to evaluate if it’s truly essential. Applying for credit too frequently can make lenders perceive you as a risk, signaling financial instability. It’s best to focus on maintaining and managing existing credit accounts while minimizing the number of new credit applications.

To keep track of your credit applications, consider using a table to create a record. List the date of the application, the type of credit requested, and the reason for the application. This table will help you monitor your credit inquiries and identify any patterns or excessive requests.

| Date of Application | Type of Credit Requested | Reason for Application |

|---|---|---|

| June 1, 2022 | Credit Card | Purchasing a new computer |

| August 15, 2022 | Auto Loan | Replacing old vehicle |

| October 10, 2022 | Personal Loan | Home renovation project |

By limiting requests for new credit, you can safeguard your credit score and improve your overall financial standing. Remember, responsible credit management involves thoughtful decision-making and a focus on building a strong credit profile.

Padding Out a Thin Credit File

If you have a thin credit file or limited credit history, don’t worry! There are steps you can take to pad out your credit file and start building a positive credit history. Establishing credit accounts is a crucial first step. Secured credit cards are a great option for those with limited credit history. These cards require a security deposit, but they function just like regular credit cards and can help you demonstrate responsible credit management.

Another option to consider is a credit builder loan. These loans are specifically designed to help individuals build credit. They work by depositing the loan amount into a secured savings account, from which you make monthly payments. As you make consistent, on-time payments, your credit file begins to grow, showcasing your ability to manage credit effectively.

While building credit, it’s important to maintain good financial habits. Pay your bills on time, keep your credit utilization ratio low, and avoid applying for too much new credit. These practices will help you establish a solid credit foundation and lay the groundwork for a healthy credit score. Remember, it takes time to build credit, so be patient and stay committed to your financial goals.

Table: Types of Credit Accounts to Consider

| Type of Account | Description |

|---|---|

| Secured Credit Card | Requires a security deposit, functions like a regular credit card |

| Credit Builder Loan | Deposits loan amount into a secure savings account, payments help build credit |

| Retail Store Credit Card | Offers credit for purchases at specific retail stores |

| Authorized User Account | Adds you as an authorized user to someone else’s credit account |

Building credit takes time and effort, but with the right strategies, you can successfully pad out your thin credit file and establish a strong credit history. Remember to review your credit reports regularly, make on-time bill payments, and keep your credit utilization low. By following these steps and being patient, you’ll be on your way to achieving a healthy credit score and financial success. I took out a car loan because I read that it would improve my score, as a result it dropped 40 points and did not recover for 4 years, lol.

Keeping Old Accounts Open

When it comes to improving your credit score, it’s often wise to keep old credit accounts open, even if you no longer use them. The length of your credit history plays a significant role in determining your creditworthiness.

Having a longer credit history demonstrates to lenders that you have a track record of responsibly managing credit over time. This can boost your credit score and make you a more attractive borrower.

While it may be tempting to close old accounts that you no longer use, doing so can actually have a negative impact on your credit score. Closing an account shortens the average age of your credit history, which can lower your score. Instead, consider keeping these accounts open and occasionally using them for small purchases to keep them active and maintain a positive credit history.

Remember, though, it’s important to stay on top of any fees associated with old accounts and periodically check for any unauthorized charges. By keeping old accounts open and responsibly managing them, you can contribute to the overall health of your credit score and increase your chances of being approved for credit in the future. I closed a CC that had not used in 2 years. I still have others.

| Benefits of Keeping Old Accounts Open |

|---|

|

Dealing with Delinquencies

Dealing with delinquent accounts can be challenging, but it’s essential for improving your credit score. In this section, we’ll provide tips on how to handle delinquencies, negotiate payment plans, and establish effective communication with your creditors.

When facing a delinquent account, it’s important to take immediate action. Start by identifying the delinquent account and understanding the severity of the delinquency. Review your account statements and contact your creditor to get a clear picture of the outstanding balance and any penalties or fees that have accrued. Getting a complete understanding of the situation will help you develop a plan to address the delinquency.

Once you have a clear understanding of your delinquent account, it’s crucial to communicate with your creditor. Reach out to them to discuss your situation and express your willingness to resolve the delinquency. Be honest about your financial circumstances and propose a realistic payment plan that fits your budget. Many creditors are open to negotiation and may be willing to offer alternative payment arrangements or debt settlement options.

In addition to negotiating payment plans, it’s important to establish effective communication with your creditors. Keep track of all correspondence, including phone calls, emails, and letters. Take detailed notes during your conversations, noting the date, time, and key points discussed. This documentation will be valuable if any disputes arise in the future. Remember to always keep your communication professional and respectful. Maintaining a positive relationship with your creditors can lead to more favorable outcomes and potential future credit opportunities.

| Bill | Due Date | Amount |

|---|---|---|

| Electricity | 15th of every month | $100 |

| Internet | 1st of every month | $60 |

| Credit Card | 20th of every month | $500 |

Alternatively, you can consider consolidating your bills by using bill consolidation services or personal loans. This can simplify your payment process by combining multiple bills into one manageable monthly payment. However, it’s important to carefully review the terms and conditions of these services to ensure they align with your financial goals.

By getting a handle on your bill payments, you can take control of your finances, improve your credit score, and work towards achieving your long-term financial goals. Remember, responsible bill management is an essential step in building good credit.

FAQ

1. Why does my payment history affect my credit score?

Think of your payment history as the highlight reel of your financial life. Lenders look at it to see if you’ve been a team player or if you’ve been dropping the ball when it comes to paying back what you owe. The better your payment history, the more confident lenders will be in your ability to pay back any future debts.

2. What’s the connection between on-time payments and my credit score?

On-time payments and your credit score are best buddies – when one goes up, so does the other. Consistently paying your bills on time shows lenders that you’re reliable and can handle the responsibility of credit. It’s like getting a gold star every time you pay on time. Collect enough, and you’ll have an A+ credit score!

3. How much does a late payment affect my credit score?

Late payments are like the villain in the story of your credit score. Depending on how late they are, how much was owed, how recently they occurred, and how many there are, they can have a significant negative impact. Even one single late payment can cause your score to drop. So, aim to defeat this villain by always paying on time!

4. If I miss a payment, how long does it stay on my credit report?

A late payment can stick around on your credit report for up to seven years. That’s like a seven-year itch you don’t want to scratch! The good news is, its impact lessens over time, especially if you establish a consistent pattern of on-time payments moving forward.

5. How can I improve my payment history?

One word: consistency. Just like doing a little bit of exercise every day is better for your health than running a marathon once a year, making regular, on-time payments is the best way to improve your payment history. You might also want to set up automatic payments, so you never accidentally miss a due date.

6. Can I remove a late payment from my credit report?

If the late payment is accurate, removing it can be tough – they’re stickier than a piece of gum on a hot sidewalk. However, if you believe the late payment is an error, you can dispute it with the credit reporting agencies. It’s also possible to request a “goodwill deletion” from your lender, especially if you’ve generally been a good customer.

7. I missed a payment but quickly made up for it. Will it still affect my credit score?

Well, late is late, whether it’s an hour or a week. Typically, lenders report late payments to the credit bureaus once they’re 30 days past due. So if you suddenly remember you forgot to pay and quickly make the payment within that window, you might dodge the credit score bullet. It’s like forgetting your lines on stage but then nailing the rest of the performance!

8. Do all late payments get reported?

Not all late payments are treated equally. Generally, payments like rent or utilities aren’t reported to credit bureaus unless they’re significantly overdue (like if your account goes to collections). On the other hand, credit card companies, mortgage lenders, and other financial institutions usually start tattling on you after 30 days. So it’s best to pay all your bills on time to avoid any nasty surprises!

9. How long does it take for on-time payments to improve my credit score?

Improving your credit score with on-time payments isn’t a quick fix, it’s more like slow-cooking a perfect stew – it takes time and patience. It’s hard to say exactly how long it’ll take since everyone’s credit history is different, but making consistent on-time payments over several months (or even years) will generally lead to an improvement.

10. If I pay off a delinquent account, does that remove the late payment history?

Paying off a delinquent account is a great step toward repairing your credit, but it’s a bit like cleaning up after a party – the mess is gone, but the neighbors still remember the noise. The late payments will remain on your credit report for up to seven years, but their impact will decrease over time, especially if you replace them with a series of on-time payments.