I was able to raise my credit score significantly within a few months by following a few simple steps. In this article, I will share my personal experience and the steps I took to improve my credit score.

Key Takeaways:

- Building your credit file by opening new accounts and maintaining active credit accounts can positively impact your credit score.

- Paying your bills on time and setting up automatic payments can help you avoid late payments and improve your creditworthiness.

- Bringing overdue accounts current is essential for improving credit scores and avoiding additional late payments.

- Keeping your credit card balances low relative to their credit limits can have a positive effect on your credit scores.

- Being cautious about submitting credit applications and limiting the number of inquiries on your credit report can help protect your credit score.

Understanding Credit Score

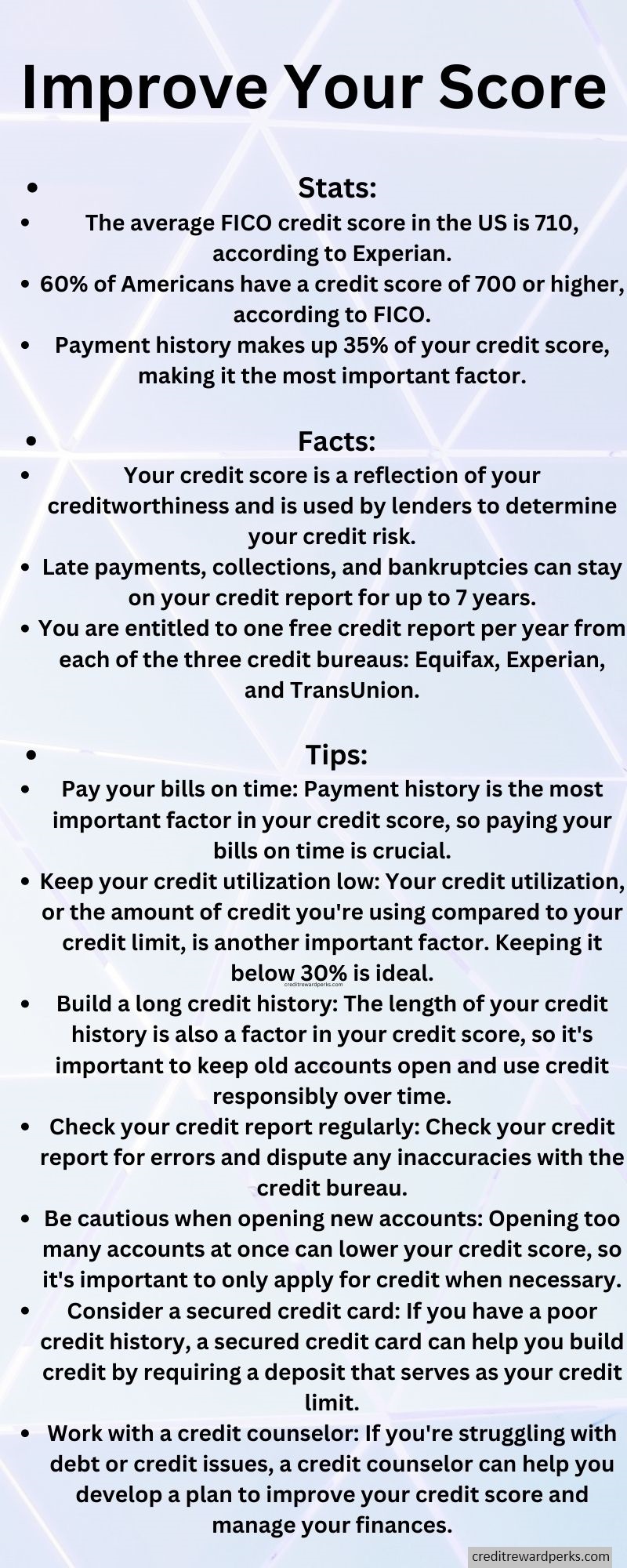

When I decided to improve my credit score, the first thing I did was research and understand what a credit score is and how it is calculated. A credit score is a numerical representation of a person’s creditworthiness. Lenders use credit scores to determine whether to approve a loan and what interest rate to charge.

Credit scores range from 300 to 850, with a higher score indicating better creditworthiness. The three major credit bureaus, Experian, TransUnion, and Equifax, calculate credit scores using different algorithms. However, the most commonly used credit score is the FICO score, which ranges from 300 to 850.

The factors that affect credit scores include payment history, credit utilization, length of credit history, credit mix, and new credit. Payment history and credit utilization are the most significant factors, accounting for 35% and 30% of the credit score, respectively.

To maintain a good credit score, it is essential to make timely payments and keep credit utilization low. Credit utilization is the amount of credit used compared to the total credit available. It is recommended to keep credit utilization below 30%.

One of the most important things I learned was to always pay my bills on time. Late payments can have a negative impact on your credit score, so it’s crucial to pay all your bills on time and in full whenever possible. I also found it helpful to keep my credit utilization low by not using too much of my available credit.

Another strategy that worked for me was to become an authorized user on someone else’s credit card. This allowed me to benefit from their good credit history and build my own credit score at the same time. I also asked for higher credit limits on my existing credit cards, which helped improve my credit utilization ratio.

Finally, I made sure to dispute any errors on my credit report. It’s important to regularly check your credit report for inaccuracies and dispute any errors you find. This can help improve your credit score and prevent any future problems.

Build Your Credit File

Building a strong credit file is crucial for improving your credit score. One effective strategy is to open new accounts that report to the credit bureaus and maintain several open and active credit accounts. This helps demonstrate to lenders that you can handle multiple types of credit responsibly.

By opening new accounts that report to the credit bureaus, you can show a positive track record of managing credit and establish a solid credit history. This, in turn, can boost your creditworthiness and increase your chances of getting approved for future credit applications.

When opening new accounts, it’s important to choose those that report to the credit bureaus. These bureaus, such as Equifax, Experian, and TransUnion, collect and maintain your credit information. By having your payment history and credit utilization reported to these bureaus, you provide potential lenders with a comprehensive view of your creditworthiness. Cool.

Additionally, maintaining multiple open and active credit accounts can also have a positive impact on your credit score. It shows that you have access to credit and are responsible for managing it effectively. However, it’s important to note that opening too many accounts within a short period of time can be viewed negatively by lenders and may result in a temporary decrease in your credit score.

| Benefits of Opening New Accounts | Considerations When Opening New Accounts |

|---|---|

|

|

Building Your Credit File Summary

Building a strong credit file is an essential step in improving your credit score. By opening new accounts that report to the credit bureaus and maintaining several open and active credit accounts, you can demonstrate your creditworthiness to potential lenders. However, it’s important to be strategic in your account selection and avoid opening too many accounts at once.

Remember to regularly review your credit reports for inaccuracies and dispute any errors that could negatively impact your credit scores. By following these steps and staying proactive in managing your credit, you can pave the way for increased financial opportunities in the future.

Don’t Miss Payments

Timely bill payment is key to raising your credit score. Make sure to pay your bills on time and consider setting up automatic payments to prevent any late payments. Late payments can have a negative impact on your creditworthiness and lower your credit score.

One way to avoid late payments is by taking advantage of automatic payments. By setting up automatic payments, you can ensure that your bills are paid on time, without the risk of forgetting or being delayed. This can help you maintain a positive payment history and demonstrate your responsible financial behavior to lenders.

Additionally, it’s important to prioritize paying your bills on time, especially those that have the biggest impact on your credit score, such as credit card payments and loan installments. Late payments can stay on your credit report for up to seven years and can have long-term effects on your creditworthiness.

Benefits of Automatic Payments:

- Convenience: Automatic payments save you time and effort by eliminating the need to manually pay your bills each month.

- Peace of Mind: You can have peace of mind knowing that your bills will be paid on time, even if you forget or are unable to do so manually.

- Avoid Late Fees: By paying your bills on time, you can avoid late fees and penalties, which can add up over time.

- Improve Credit Score: Consistently paying your bills on time can help improve your credit score over time, making you more creditworthy.

Catch Up On Past-Due Accounts

If you have any past-due accounts, it’s crucial to catch up on payments to improve your credit scores and prevent any further late payments. Late payments can have a significant negative impact on your creditworthiness, making it harder for you to get approved for loans, credit cards, or other financial opportunities. By bringing your overdue accounts current, you can start rebuilding your credit and working towards a better financial future.

One way to catch up on past-due accounts is to create a repayment plan. Take a look at your outstanding debts and prioritize them based on their interest rates, amounts owed, and due dates. Allocate a portion of your monthly budget toward paying off these past-due balances, starting with the accounts that have the highest interest rates or the largest amounts owed. Set realistic goals and stick to your repayment plan to ensure that you make progress in reducing your past-due balances.

| Steps to Catch Up on Past-Due Accounts |

|---|

| Create a repayment plan |

| Prioritize debts |

| Allocate a portion of your budget |

| Set realistic goals |

| Stick to your repayment plan |

If you’re struggling to catch up on payments, consider reaching out to your creditors to discuss possible options. They may be willing to negotiate a payment arrangement or provide assistance to help you get back on track. Remember, taking proactive steps to address your past-due accounts demonstrates responsibility and a commitment to improving your financial situation, which can positively impact your credit scores over time.

By catching up on past-due accounts, you’ll not only improve your credit scores but also avoid additional late payments that can further damage your creditworthiness. Take control of your finances today and make a plan to tackle those overdue balances, one payment at a time.

Pay Down Revolving Account Balances

Lowering your credit card balances in relation to your credit limits can significantly boost your credit scores. It shows lenders that you are responsible with your credit and can manage your debts effectively. Here are some practical tips to help you manage your revolving account balances:

- Pay more than the minimum: Aim to pay more than the minimum amount due on your credit card each month. This will help you reduce your balances faster and save money on interest charges.

- Create a budget: Take a closer look at your finances and identify areas where you can cut back on expenses. Use the extra savings to put towards paying down your credit card balances.

- Focus on one card at a time: If you have multiple credit cards with balances, consider focusing on paying off one card at a time, starting with the card that has the highest interest rate. Once that card is paid off, move on to the next one.

- Utilize balance transfers: If you have a high-interest credit card balance, look for credit card offers with low or 0% introductory APR on balance transfers. Transferring your balance to a card with a lower interest rate can help you save money and pay off your debt faster.

Remember, lowering your credit card balances takes time and discipline. It’s essential to stick to your payment plan and avoid accumulating new debt. By effectively managing your revolving account balances, you can improve your credit scores and increase your chances of qualifying for better interest rates and financial opportunities.

| Credit Card | Balance | Credit Limit |

|---|---|---|

| Card A | $1,500 | $5,000 |

| Card B | $3,000 | $8,000 |

| Card C | $500 | $2,000 |

“Paying down your credit card balances not only improves your credit scores but also saves you money in the long run. It’s like giving yourself a financial boost.” – Financial Expert

Additional Tips for Managing Revolving Account Balances

- Set up balance alerts: Most credit card issuers offer balance alert notifications. Take advantage of this feature to receive alerts when your balances reach a certain threshold.

- Avoid maxing out your credit cards: Maxing out your credit cards can harm your credit scores. Try to keep your credit utilization below 30% to maintain a healthy credit profile.

- Consider a debt consolidation loan: If you are struggling to manage multiple credit card debts, consolidating them into a single loan with a lower interest rate can simplify your payments and help you pay off your debt more efficiently.

By implementing these strategies and staying disciplined, you can successfully manage your revolving account balances and improve your credit scores over time. Remember, every effort counts, and taking small steps today can lead to significant financial benefits in the future.

Limit How Often You Apply for New Accounts

Applying for new credit accounts too frequently can have a negative impact on your credit score. Learn how to be strategic when applying for new credit and minimize the number of inquiries on your credit report.

When you submit a credit application, it generates what’s called a “hard inquiry” on your credit report. These inquiries are visible to lenders and can lower your credit score. While a single inquiry may only have a minor impact, multiple inquiries within a short period of time can significantly decrease your creditworthiness.

To minimize the number of inquiries on your credit report, it’s important to be strategic when applying for new credit accounts. Only apply for credit you truly need and avoid submitting multiple applications within a short timeframe. Before applying, research the lender’s credit requirements and make sure you meet their criteria. This will help increase your chances of approval and minimize the risk of unnecessary inquiries on your credit report.

By being selective in your credit applications, you can protect your credit score and improve your chances of obtaining credit when you truly need it. Remember, a healthy credit report with a minimal number of inquiries demonstrates responsible credit management and increases your chances of qualifying for favorable interest rates and terms.

| Tip: | Use secured credit cards or alternative credit-building options if you’re working to establish or rebuild your credit. These options typically have less stringent credit requirements and can help you build a positive credit history without the need for frequent credit applications. |

|---|

Review Your Credit Reports

Your credit reports contain vital information that impacts your credit score. Regularly reviewing your credit reports is essential to identify and correct any inaccuracies or errors that could harm your creditworthiness. By following the steps below, you can ensure that your credit reports are accurate and up to date.

Step 1: Obtain Your Credit Reports

To begin, request a copy of your credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. You can do this for free once a year through AnnualCreditReport.com. Take the time to review each report individually, as they may contain different information.

Step 2: Check for Errors or Inaccuracies

When reviewing your credit reports, carefully examine each section for any errors or inaccuracies. Look for incorrect personal information, such as your name, address, or social security number, as well as any accounts that you do not recognize.

Additionally, verify that the account balances, credit limits, and payment history are accurately reflected. Even a small error or discrepancy could have a negative impact on your credit score.

Step 3: Dispute Errors and Inaccuracies

If you identify any errors or inaccuracies on your credit reports, take action immediately. Contact the credit bureau in writing and provide detailed information about the error or discrepancy. Include any supporting documents, such as copies of statements or payment records, to strengthen your case.

The credit bureau is required to investigate your dispute within 30 days and correct any errors if they are found. Once the investigation is complete, you will receive an updated credit report with the necessary corrections.

Regularly reviewing your credit reports and disputing any errors or inaccuracies is crucial for maintaining a healthy credit score. By taking this proactive approach, you can ensure that your creditworthiness is accurately represented and improve your financial prospects.

| Key Points: |

|---|

| Regularly review your credit reports to identify and correct any errors or inaccuracies. |

| Contact the credit bureaus to dispute any errors or discrepancies found. |

| Provide detailed information and supporting documents to strengthen your case. |

| The credit bureaus are required to investigate and correct any errors within 30 days. |

Get Credit for Monthly Bill Payments

Did you know that you can include your monthly utility, cellphone, and streaming service payments in your credit report? Discover how Experian Boost can help you strengthen your credit profile.

Experian Boost is a powerful tool that allows you to add positive payments from your utility, cellphone, and streaming service providers to your credit report. This means that your responsible payment behavior can now be recognized and contribute to improving your credit score.

By linking your accounts to Experian Boost, you can showcase your consistent and timely payments, giving lenders a more complete picture of your creditworthiness. This can make a significant difference in your credit profile, especially if you have limited credit history or are looking to rebuild your credit.

How Experian Boost works

Experian Boost works by securely connecting to your online banking accounts and analyzing your payment history. It identifies eligible payments and allows you to add them to your credit report. The process is quick, easy, and free.

Once you’ve added your positive payments, you can instantly see the impact on your credit score. Experian Boost takes into account your payment history, which can make up a significant portion of your credit score, and helps you demonstrate your financial responsibility to lenders.

| Benefits of using Experian Boost |

|---|

| Boost your credit score with positive payments |

| Showcase your responsible financial behavior |

| Improve your chances of qualifying for better credit offers |

| Gain a more complete credit profile |

Take control of your credit profile

With Experian Boost, you have the power to take control of your credit profile and increase your financial opportunities. By adding your positive utility, cellphone, and streaming service payments to your credit report, you can demonstrate your creditworthiness and improve your chances of getting approved for credit in the future.

Remember, responsible financial behavior is key to building a strong credit history. Make sure to continue making timely payments on all your accounts and use credit responsibly. By following these steps and utilizing tools like Experian Boost, you can set yourself up for financial success and achieve your goals.

Complete Table: “`

| Benefits of using Experian Boost |

|---|

| Boost your credit score with positive payments |

| Showcase your responsible financial behavior |

| Improve your chances of qualifying for better credit offers |

| Gain a more complete credit profile |

“`

Keep Old Accounts Open

It’s crucial to keep your old credit accounts open to preserve your credit history and maximize your total credit limit. Find out why maintaining these accounts can positively impact your credit score.

When it comes to your credit history, longevity matters. The length of your credit history is a significant factor that lenders consider when assessing your creditworthiness. By keeping your old credit accounts open, you demonstrate a long-standing and responsible credit history, which can boost your credit score.

Additionally, the total credit limit across all your accounts is another important aspect that lenders evaluate. Your credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit, plays a role in determining your credit score. By maintaining your old accounts, you increase your total credit limit, which can help lower your credit utilization ratio and improve your credit score.

While it may be tempting to close old accounts that you no longer use, it’s important to consider the potential impact on your credit score. Closing an old account can shorten your credit history and reduce your total credit limit, which may negatively affect your creditworthiness. Instead, keep those accounts open and active, even if you only use them occasionally for small purchases, to reap the benefits of a longer credit history and higher total credit limit.

Summary

Maintaining your established credit accounts is essential for preserving your credit history and maximizing your total credit limit. By keeping these accounts open and active, you demonstrate a long credit history and increase your total credit limit, both of which can positively impact your credit score. Avoid the temptation to close old accounts, as doing so may shorten your credit history and reduce your total credit limit, potentially lowering your creditworthiness. By following this advice, you can improve your credit score and increase your financial opportunities.

| Key Points | Benefits |

|---|---|

| Preserve your credit history | Boost your credit score |

| Maximize your total credit limit | Lower your credit utilization ratio |

| Keep old accounts open and active | Increase your creditworthiness |

Limit New Lines of Credit

Applying for credit you truly need is important to prevent excessive hard inquiries on your credit report. To protect your credit score, it’s crucial to be mindful of new credit applications and understand how they can impact your financial health.

First, it’s essential to evaluate whether you genuinely require the new credit line. Taking on unnecessary credit can lead to increased debt and higher risk of missed payments. Before applying, carefully consider if the credit is necessary and if you can responsibly manage the additional financial responsibility.

Additionally, be cautious about the number of credit inquiries appearing on your credit report. Each time you apply for credit, a hard inquiry is generated, which can temporarily lower your credit score. Lenders may perceive numerous inquiries as a sign of financial instability, potentially affecting your creditworthiness.

To minimize hard inquiries, limit new credit applications to only those that are essential. Focus on building a strong credit history with your existing accounts before seeking additional credit. This approach not only protects your credit score but also helps maintain a healthy financial foundation.

500

Getting a credit card with a 500 credit score is no easy feat. Your credit score is based on several factors, primarily your payment history and the total amount of debt you have. This means that if you have high debt and a history of late payments, you may have a hard time qualifying for a regular credit card. To improve your credit score, follow these simple tips. Keeping your account active and making payment on time will help you increase your score over time.

A 500 credit score can be a sign of past credit challenges or no credit history. It can make it difficult to get approved for a credit card, since lenders use a credit score to determine whether they’re a good risk. On a 300 to 850 scale, a credit score of 500 means that you are high risk.

The average credit score reported by Experian in 2021 was 716 and varies by age:

18-23: 674

24-39: 680

40-55: 699

56-74: 736

75+: 758

600

One of the best options for people with a credit score of 600 or less is a Capital One Platinum Mastercard. Although it has a high APR, no annual fee, and a long list of other charges, this card is best for people with a good credit score who plan on using it for occasional purchases and not carrying a balance. It is also a relatively new credit card, so it is worth considering if you’re trying to rebuild your credit score.

First of all, a credit card with a credit limit of under $300 can help your 600 credit score because the card automatically reports payment information to the major bureaus. However, if you have an expensive credit card, such as a cash rewards credit card, you need to be careful to avoid maxing out your limit, because this will lower your credit utilization ratio and damage your credit score. Lastly, make sure to pay your bills on time and make all of your payments on time.

700

It is possible to build a credit score of 700. You can accomplish this by using various credit profile types. For example, an A in Credit Utilization may offset a B in Account Age. It is vital to look at the entire picture when determining your credit score. Here are some ways to raise your score. Use this information to plan your finances accordingly. If you are thinking of applying for a new line of credit, start by limiting your new applications.

To increase your buying power, you should try to get pre-approved for a car loan. Your score will determine the interest rate you pay for the car loan, but a pre-approval letter shows the car dealer that you have done your research. A pre-approval letter also may result in a hard inquiry on your credit, which is only temporary. Getting pre-approved will also enable you to refinance an existing car loan.

800

It is possible to get an 800 credit score with good payment history, but it may take several years to get there. You need a few major credit cards, a real estate loan, and some type of installment loan. All of these accounts should be at least a few years old. If you have any of these, you can apply for a credit-builder loan. This type of loan is designed to establish a credit history that reflects good payment history.

Having an 800 credit score can help you get the best deals on travel cards. These cards usually come with higher credit limits and sign up bonuses. These incentives can be extremely attractive. For example, if you want to travel extensively, a high credit score will help you qualify for the best flights and hotels. You can also enjoy lower interest rates on credit cards if you use them for business travel. You can also qualify for a zero percent promotional rate on balance transfers.

Experian reports these factors affect your score:

- Payment history – 35%

- Credit history length – 15%

- Amount owed – 30%

- Credit Mix – 10%

- New Credit – 10%

List of things that hurt your score:

- Missing payments

- Utilization rate

- Too many applications

- Accounts in default

1. Pay your bills on time, because late payments are so last season!

Paying your bills on time is like showing up to a party fashionably early. It’s a responsible financial move that tells lenders you’re reliable and can be trusted with credit. So, set up reminders, put on your best punctuality hat, and make those payments like a true financial superstar.

2. Keep your credit card balances low, like that buffet table after a diet trend hits!

High credit card balances are like carrying around a weighty backpack full of debt. It can weigh down your credit score faster than a gym session can burn off those extra calories. So, keep your balances low, ideally below 30% of your credit limit, and watch your credit score soar like a bird freed from its cage.

3. Don’t close old credit cards, they’re like vintage fashion pieces!

Old credit cards are like timeless fashion items—they show you have a history. Closing them can be like throwing away your favorite retro jacket. Instead, keep those old credit cards tucked away in your financial closet. They contribute to your credit history and demonstrate your longstanding relationship with credit.

4. Be a responsible credit user, like a dog walker who always cleans up after their furry friends!

Responsible credit usage is like being a responsible dog walker. Just as you clean up after your canine companions, make sure to clean up any outstanding balances on your credit cards. Carrying balances and only paying the minimum due can make your credit score bark in frustration. So, be a responsible credit user and show your credit score some tender loving care.

5. Mix it up, like a colorful smoothie bowl of credit types!

Credit diversity is like a vibrant smoothie bowl—it’s a mix of flavors that makes life exciting. Having a healthy mix of credit types, such as credit cards, loans, and a mortgage, can enhance your credit score’s palate. So, embrace a diverse credit portfolio and savor the benefits it brings.

6. Avoid applying for too much credit at once, unless you enjoy long lines at the DMV!

Applying for multiple lines of credit at once is like trying to juggle a dozen tasks at the same time—it can be overwhelming and lead to mishaps. Each credit application leaves a footprint on your credit report, and too many footprints can raise eyebrows. So, pace yourself and apply for credit strategically, just like avoiding those long DMV lines.

7. Keep an eye on your credit report, like a vigilant superhero watching over their city!

Monitoring your credit report is like being a vigilant superhero, keeping an eye out for any suspicious activity. Regularly checking your report allows you to catch errors or potential fraud early on. It’s like having your own personal credit superhero cape, protecting your financial well-being.

8. Become friends with credit utilization, but don’t get too clingy like a barnacle on a ship!

Credit utilization is like a good friend—it’s important to maintain a healthy relationship without becoming too clingy. Utilizing a moderate amount of your available credit is like finding the perfect balance between enjoying a good time and not overstaying your welcome. So, keep your credit utilization in check, like a responsible friend who knows when it’s time to bid farewell.

9. Be patient, because credit score improvements don’t happen overnight, unlike those “get rich quick” schemes!

Patience is a virtue, especially when it comes to raising your credit score. It’s like waiting for that perfect cup of coffee to brew in the morning—it takes time but is well worth it. Credit score improvements require consistent, responsible financial habits over time. So, grab your imaginary cup of patience and savor the journey towards a better credit score.

10. Embrace the power of negotiation, like a master negotiator with a plate of warm cookies!

Negotiating with creditors is like offering warm cookies to smooth out any financial bumps in the road. If you’re facing difficulty making payments, reach out to your creditors and see if you can work out a modified payment plan or negotiate reduced interest rates. It’s like being a financial Jedi, using your charm and negotiation skills to find a solution that works for everyone.

11. Dance with a credit-builder loan, because who can resist a good dance party, right?

A credit-builder loan is like a dance partner that helps you twirl your credit score in the right direction. This type of loan allows you to make small, regular payments that build positive credit history. It’s like dancing your way to a better credit score, one step at a time. So, put on your dancing shoes and let the credit-building dance begin!

12. Seek professional guidance, like having a wise owl in your financial forest!

Sometimes, navigating the credit world can feel like wandering through a dense forest. That’s when seeking professional guidance becomes essential. Whether it’s a credit counselor, financial advisor, or a knowledgeable friend, having someone to shed light on your credit journey is like having a wise owl guiding you through the forest. So, let their expertise be your compass and trust their guidance.

In the realm of credit, a journey we embark, A tale of numbers and scores, like a dance in the dark. To raise your credit score, let’s find a way, Through a poetic journey, let’s guide your way.

Pay your bills on time, a rhythm so true, Like a metronome ticking, keeping debt at bay. Be prompt like a clock, never miss a beat, Your credit score will rise, it’s a guaranteed treat.

Keep credit card balances low, a delicate sway, Like a tightrope walker, finding balance each day. Don’t max out your cards, that’s a financial sin, Keep your utilization low, let your credit score win.

Embrace credit diversity, like colors in bloom, A mix of loans and cards, like a vibrant costume. With mortgage, car loan, and cards in a blend, Your credit profile shines, like a rainbow’s end.

Old credit cards, don’t bid them adieu, Their history is gold, like a vintage debut. Keep them alive, they add years to your tale, A credit history treasure, like an ancient holy grail.

Be responsible, a credit champion you’ll be, Like a hero in disguise, solving credit mysteries. Pay debts on time, like a hero’s quest, Your credit score will soar, you’ll be among the best.

Monitor your credit report, a vigilant guard, Like a watchtower high, standing ever so hard. Catch errors and fraud, with a vigilant eye, Your credit story safe, like a fortress in the sky.

Remember, my friend, to raise your credit score, It takes patience and effort, and a little bit more. Through responsible choices and financial might, Your credit will shine, like a star in the night.

So, let this poem be your guide on this credit quest, Take each step with care, and give it your best. May your credit score rise, like a phoenix in flight, And your financial future, forever be bright.