Before you apply for a credit card, you may have heard of a soft pull or a preapproval. These two terms describe different processes for getting credit card pre approval. Both processes allow you to gauge your chances of approval, but a soft pull is not a guarantee.

You must complete a formal application to trigger a hard inquiry, which gets a more detailed look at your credit history. This can affect your credit score.

Pre-qualification

As I was learning about credit, I came across the term “credit inquiries.” I learned that credit inquiries are requests made by lenders or creditors to view my credit report. These inquiries can be categorized as either hard or soft credit pulls. Before this, I had always assumed that checking my credit score would have a negative impact on it. So now I am more careful about this. I stopped requesting credit for a year and my score went up 30 points.

A soft pull credit card pre approval is available from most issuers. Many issuers send prescreened credit card offers to their customers. Soft pull preapproval is not an instant approval, but it can help you reduce the number of hard credit inquiries. Using a soft pull tool, such as CardMatch, is a great way to search across several issuers and check your eligibility. Once approved, the card will send you a notification letting you know which offers are available.

While soft pull credit cards are not as widely available as regular rewards credit cards, they can help you get started with a low credit score. They can be a great way to build credit while also keeping a tight rein on your spending. You can also get a credit card with a low initial limit (a thousand dollars), if you qualify. Reflex Mastercard has a history of boosting credit limit requests. Depending on your credit score, you can choose a card with low fees and high rewards.

A pre-qualification form gives lenders partial information, whereas the official application provides a complete picture of your finances. Many factors are taken into consideration, including your monthly housing payment and employment status. Typically, the credit card pre-qualification form results in a few credit card offers. You can then decide to submit your application after reviewing the offers. The application will require a pre-approval. A soft pull credit card pre approval form does not guarantee approval, but it is a good way to compare different credit card offers and find out if one suits you.

Another benefit of a soft pull credit card pre approval is that there is no commitment involved. Unlike a hard inquiry, a soft pull does not affect your credit score. A hard inquiry will be done if you choose to pursue the card after the pre-approval process. But if you decide to go ahead with the application, you won’t need to worry about your credit score. So if you’re interested in a card, soft pull credit card pre approval may be just what you need.

Pre-approval

When you apply for a credit card or a loan, you may be asked to provide your credit report. This is called a “hard inquiry.” This type of inquiry will lower your credit score, but it is relatively minor. Typically, a soft inquiry is not reflected on your report. A lender may also perform a hard inquiry to check your credit. The difference between the two types of inquiries is that a hard inquiry will lower your score by several points while a soft inquiry will not have a significant effect on your credit rating.

There are several benefits to a soft pull credit card pre approval. First, the lender is likely to approve your application. Soft inquiries, or pre-approval, are a better option for those with bad credit. This is because they won’t damage your score as much as a hard inquiry. In addition, a soft inquiry isn’t connected to a specific application for new credit. And, unlike a hard inquiry, it won’t show up on your credit report.

Another advantage to a soft pull credit card is that it can be used for recurring, small charges. This way, you’ll be able to pay it off as quickly as possible, which helps you limit interest charges and maintain low credit utilization. Soft pull cards may also have limits that limit how much you spend, but they are generally more liberal than hard pull cards. However, if you plan to use a soft pull credit card for larger purchases, make sure you know exactly what you’re getting into.

Lastly, you can use a soft pull credit card pre approval tool to check your chances of approval and limit the number of unnecessary hard pulls on your credit. It is possible to obtain a soft pull credit card pre approval using a third-party tool or issuer site. By using a soft pull on your account, you can be assured that you’ll qualify for a credit card based on your financial history.

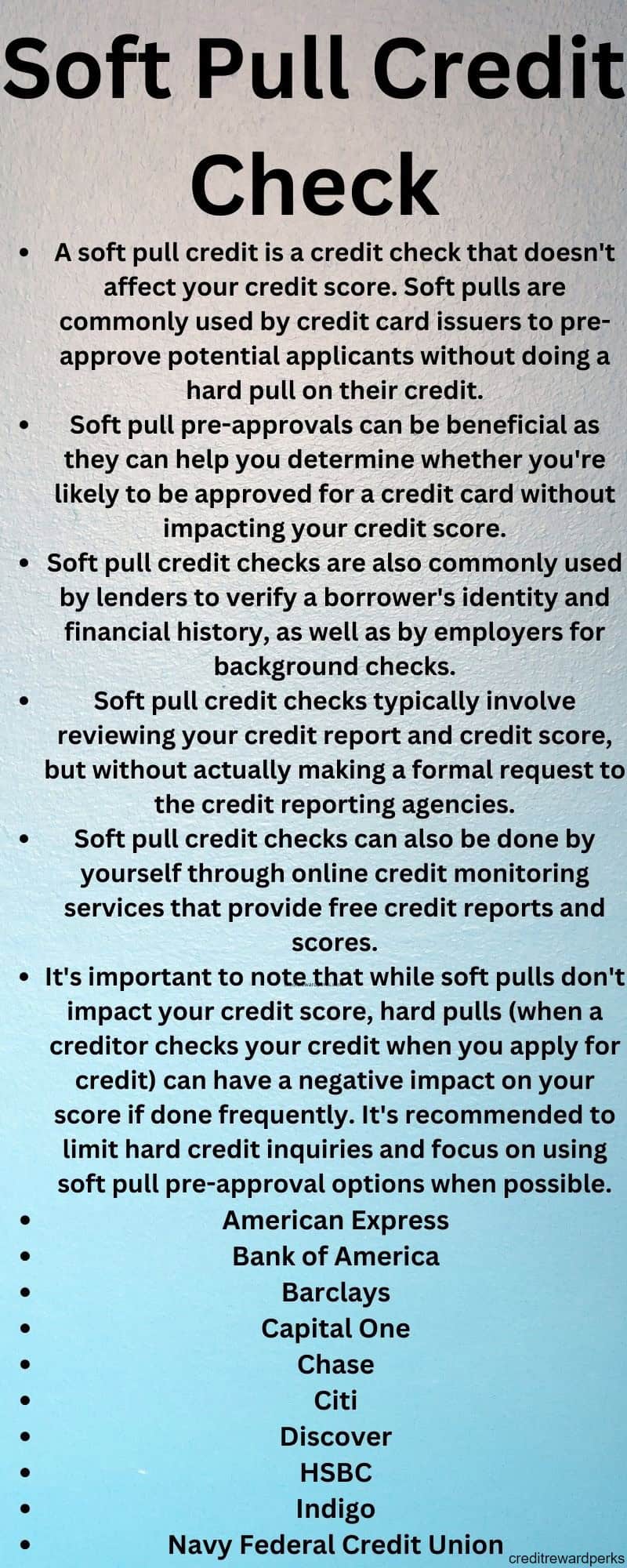

List of banks offering pre approved cards will soft pull:

With good credit:

- American Express

- Chase

With poor credit:

- Bank of America

- Capital One

- Citi

- Discover

- USAA

- US Bank

- Wells Fargo

- First Progress

- Applied Bank

- OpenSky

Hard inquiry

Before submitting an application for a credit card, lenders run a soft inquiry to confirm your identity. Though this doesn’t hurt your credit score, applying for a pre-approved card will trigger a hard inquiry, which may temporarily lower your score. Before submitting your application for a credit card, you should familiarize yourself with the terms of the card, including the annual fee, interest rate range, and rewards program.

Most credit cards do not allow for soft pulls, and instead require a hard inquiry, which will hurt your credit score. Lenders view this as an attempt to take on more debt. If you’re desperate to get a credit card, consider using a secured card, which doesn’t check your credit. The only catch is that a secured card will not allow you to carry a balance larger than the security deposit.

A soft pull credit card can be useful for small recurring charges that will be paid off quickly. These cards are great for keeping your credit utilization low and account active. While soft pull cards have certain limitations, you’ll still have a better chance of being approved. Many soft pull credit cards are secured cards, which may have fees and apply for a more conservative credit score.

If you want to apply for a credit card, make sure you understand what a hard pull means. A hard pull is a deep dive into your account history and credit report. It’s typically required for an application for most lines of credit or lender approval. Though this does affect your score, it doesn’t affect it permanently. Most hard pulls bounce back within a year. You can avoid them by knowing what a soft pull means for your credit score.

A soft inquiry is when a company looks into a potential customer’s credit history without conducting a hard inquiry. These inquiries are conducted to verify your identity and determine the demographics that will be marketed to you. While you can access your credit report for free each year from the three major bureaus, your current creditors and lenders are likely to perform a soft inquiry. Your credit card provider will likely perform this every month.

Impact on credit score

A soft pull credit card pre approval does not harm your credit score. A soft inquiry, also known as a soft pull, involves the company running a credit check to see if you meet the requirements for the card. It won’t hurt your score because there’s no specific application involved. Also, it won’t appear on your report. However, multiple requests for a preapproval will cause a small impact on your score.

Most major credit card companies do soft pulls. They do this so they can send you relevant offers and get you to sign up for their credit cards. These soft pulls help people find credit cards, and are generally harmless. Soft pulls may also be involved when requesting insurance quotes. You should read the terms and conditions of any credit card offer before applying. Make sure to check the interest rate range and the rewards included with the card.

A soft inquiry will not affect your credit score directly. However, lenders make soft inquiries when you apply for credit. They check certain details, such as your credit score, to see if you’re eligible for the product. However, this doesn’t mean that you’re automatically approved for the credit card. If you’re not approved, you can still submit your application, even if you already received a preapproval offer.

A soft pull is a non-binding inquiry on your credit report. The lender will make a soft inquiry on your report, but it will not impact your credit score. A soft inquiry will only be recorded on your credit report, but it won’t show up on your score. A hard inquiry, by contrast, will affect your score. This is because you didn’t actually apply for the credit card, but just gave permission to the company to pull your credit report.

Hard inquiries affect your credit score negatively. While they only affect a small percentage of your score, they’re still bad news. A hard inquiry will lower your score by a few points. Depending on how many of these inquiries you have made in the past 12 months, this may take up to two years to disappear from your credit history. However, this type of inquiry is often removed before it has an impact on your score.

FAQ

1. What in the world is a “soft pull credit card pre-approval”?

Well, imagine someone taking a quick peek at your financial behavior, like a nosey neighbor, but instead of judging your lawn care, they’re checking if you’re creditworthy. This is essentially a soft pull credit card pre-approval. It’s a way for credit card issuers to see if you’re their type (financially speaking), without hurting your credit score. It’s like window shopping for lenders!

2. How is a soft pull different from a hard pull?

Here’s the lowdown: a soft pull is like a gentle pat on the back—it doesn’t hurt your credit score. On the other hand, a hard pull is like a poke in the eye; it can leave a mark on your credit report and potentially decrease your score. A hard pull happens when you formally apply for credit. So be wary of these financial eye-pokes!

3. Do all credit card issuers do a soft pull pre-approval?

In the magical land of credit, not all creatures play by the same rules. Some credit card issuers offer soft pull pre-approvals, while others might not. Check with the specific issuer to see if they offer this no-impact peek at your creditworthiness.

4. Does a pre-approval mean I’m guaranteed to get the card?

Sadly, a pre-approval is not a magic ticket to Credit Card Land. It’s more like getting a “probably” from a Magic 8-Ball. While it’s a positive sign, the issuer will still do a hard pull when you actually apply, and they might find something they didn’t see in the soft pull. So don’t count your credit cards before they’re hatched!

5. How do I get pre-approved?

Some credit card issuers allow you to check online if you’re pre-approved. It usually involves entering some basic information about yourself on their website. It’s like speed dating, but for credit cards. Also, some issuers might mail you a pre-approval offer. Yes, people still use mail!

6. I got pre-approved! Now what?

Congrats, you’ve caught the eye of a credit card issuer! If you’re interested in the card, you can apply formally. But beware, this will involve a hard pull. So take a deep breath, cross your fingers, and hope your credit score has been doing its sit-ups!

7. Can I opt-out of pre-approval offers?

If you’re feeling like you’re getting too much love from credit card companies with their pre-approval letters, fear not! You can opt-out of these offers by visiting optoutprescreen.com or by calling 1-888-5-OPT-OUT. You can choose to opt-out for five years or permanently. Just like unsubscribing from that annoying email newsletter, but for snail mail!

8. What are the advantages of a soft pull pre-approval?

One significant advantage is that it’s like getting a sneak peek at whether you’re likely to get approved for a card without the lender leaving any footprints. It’s kind of like being a financial ninja! Plus, if you are pre-approved, there’s a pretty good chance (though not guaranteed) that you’ll be approved if you decide to apply.

9. Can a soft pull turn into a hard pull?

Well, a soft pull won’t morph into a hard pull on its own. But if you proceed with the actual application after receiving a pre-approval, then yes, a hard pull will happen. It’s like going from window shopping to making a purchase; the credit card issuer needs to take a more in-depth look at your credit history.

10. Does a pre-approval offer mean I’ll get favorable terms?

Not necessarily. Think of it as being invited to a party, but you still don’t know if they’re serving top-shelf beverages or bargain brand soda. You’ve been pre-approved, so the issuer likes what it sees generally, but the specific terms like your credit limit and interest rate will be decided when you officially apply.