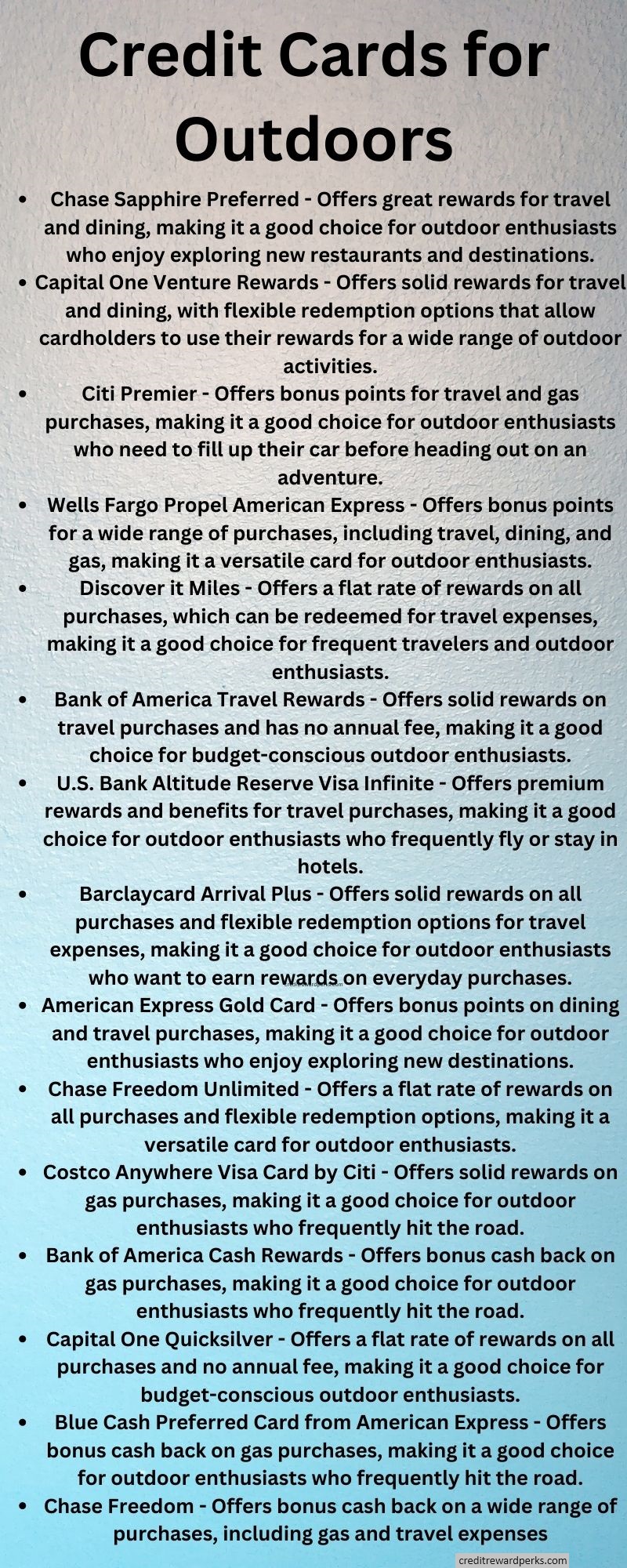

I love the outdoors and always use a card to get points for making purchases.

I have found that outdoor retailers have better credit card designs than banks and feature outdoor imagery, as well as practical benefits.

Bass Pro Shops Outdoor Rewards card

If you’re all about that outdoor life, you might wanna check out the Bass Pro Shops Outdoor Rewards card. These cards come with a whole heap of benefits, like rewards and free shipping, which is pretty darn sweet!

To sign up for one of these cards, all you gotta do is swing by basspro.com/outdoorrewards and fill out the online application. Now, before you get started, keep in mind you’ll need a few things handy: your credit card account number, your SSN or TIN, and you’ll need to give the okay to share your email address with Bass Pro Shops. Don’t forget, you’ll also need a physical address for your account.

So, if you’re ready to score some rewards while gearin’ up for your next adventure, go ahead and get that application in! Happy outdoor explorin’, y’all!

The Bass Pro Shops Outdoor Rewards Platinum Plus Visa is an excellent choice for people with good credit. This credit card comes with no annual fee, offers a rewards program, and contributes to conservation efforts with every purchase. Applicants can also enjoy various internet account services from this card issuer, including shopping for merchandise. For example, if you spend $1,000 on a Bass Pro Shops product, you will earn a $25 gift card.

In addition to earning CLUB points, owners of the Cabela’s Outdoor Rewards card can redeem their points for items at both Bass Pro Shops and Cabela’s. They also earn 1% back on purchases from Cabela’s stores. And since their cards are Mastercards, members can use them anywhere they are accepted. It’s a win-win situation for everyone. It pays to own one of these cards!

Points will post within 24 hours of purchase. However, you may experience some delay if the purchase you made falls on a non-processing day or on a holiday. Also, if you make a purchase through a promotional offer, points may take several billing cycles to post. However, the reward program is worth every cent. The rewards card is worth $500 each year, so you can get the most out of it!

I recently had the opportunity to use my Bass Pro Shops Outdoor Rewards card and was pleasantly surprised by the benefits it offered. As an avid outdoorsman, I frequently shop at Bass Pro Shops for all my hunting and fishing needs. When I learned about the Outdoor Rewards program, I knew it was something I had to sign up for.

The application process was quick and easy, and I received my card in the mail within a few days. The card offers a variety of perks, including points for every purchase made at Bass Pro Shops and Cabela’s, as well as exclusive member-only discounts and access to special events. I was excited to start earning points and taking advantage of the discounts. I picked up a fishing pole and electronic fish finder and earned 3500 points.

Alaska Airlines Visa

If you enjoy taking advantage of discounts on outdoor gear and traveling, you may be interested in applying for an Alaska Airlines Visa outdoor gear credit card. However, you need to keep in mind that this type of credit card comes with an annual fee. If you are approved for an Alaska Airlines credit card, you can expect to enjoy a variety of benefits, including companion fares and Alaska miles. Unfortunately, if you live outside of the airline’s service area, you may not find much value in the card.

The Alaska Airlines Visa outdoor gear credit card comes with a companion card, which allows you to book award flights with your partner. You can also redeem your miles for hotel stays at more than 400,000 locations. You can also upgrade to First Class when you earn enough miles. And unlike most other travel credit cards, your miles do not expire. If you need to use your card for outdoor gear, you can reinstate your miles after one year at a time for a fee.

Another benefit is the sign-up bonus. For this card, you will earn 60,000 miles after spending $3,000 in the first 90 days. The sign-up bonus also comes with the famous companion fare, which allows you to book an additional companion flight for just $121 a piece. As the card comes with a $75 annual fee, the only downside is that the bonus benefits apply to frequent flyers on Alaska Airlines.

The REI Visa card provides additional benefits besides miles. Aside from being free of annual fee, it gives you an extra 5% dividend when you purchase any item at REI. You can also get a 100 dollar gift card when you sign up, although you have to use the card only for purchases at REI. On the other hand, the Alaska Airlines Visa card gives you the chance to earn free miles with Alaska Airlines.

It also offers complimentary checked baggage and companion fares. It may be a good choice for travelers who love the Alaska Airlines airline. But it’s worth considering all the other rewards if you’re not interested in a high annual fee. IMO.

REI Co-op Mastercard

The REI Co-op Mastercard is a sweet deal for outdoor enthusiasts! This card hooks up its members with a whole bunch of benefits, like 5% cash back on all purchases. Plus, every March, REI dishes out a 10% member dividend, which is a nice little bonus for those who love to shop for gear. With no annual fee, you’ve got plenty of reasons to toss this card in your wallet!

Now, let’s talk perks. The REI Co-op Mastercard not only gives you that 5% cash back, but you can also score a bonus of up to $600 in gift cards. REI has some flagship stores in the Cascade district of Downtown Seattle, and you can also find ’em in places like New York City, Washington, DC, Denver, and Sumner, Washington. They’ve even got distribution centers in Sumner and Bloomington, Minnesota.

When you use the card, you’ll earn an annual dividend equal to 10% of your previous purchases. Just keep in mind that it becomes nonredeemable two years after it’s issued. But don’t worry—you can cash it in as cash or a check between July 1 and December 31 of the year it’s valid. So, if you’re lookin’ to rack up rewards while gearin’ up for your next outdoor adventure, the REI Co-op Mastercard is definitely worth a look!

The REI credit card comes with no annual fee and a lifetime membership costs $20. The lifetime membership includes access to REI’s semi-annual garage sales, where you can save up to 50 percent on gently used gear. Additionally, you’ll get a monthly dividend on your purchases, which is added to your card rebates. You can share your card with family members as you earn dividends with them.

The REI Co-op Mastercard is available at a wide variety of merchants and online retailers. You can even earn up to 10 percent back on pricier gear with the card. For example, a $400 Garmin Forerunner 645 running watch can earn up to $20 in dividends. That’s a $20 extra that you might not have had before. You’ll be able to use that money to buy more gear, too.

With the REI Co-op Mastercard for outdoors gear, you can buy or trade-in gently used outdoor gear. You can trade-in most types of clothing, shoes, sleeping bags, backpacks, tents, and even bicycles. REI will give you up to 50% of its retail value for your gently used gear. The program also accepts gear you may have previously purchased from REI or any other retailer.

Synchrony Retail partners offer financing for camping trips

If you’re planning a camping trip, consider the benefits of using a financial service provider like Synchrony. The company’s online platform makes it easy for partners to offer financing on the spot. All you need is a customer’s name and mailing address to instantly render a credit decision. And thanks to its SyPI technology, you can offer credit, service your account, and make payments – all through your mobile device. The company’s customers have already benefited from this feature, with over $6 billion in credit card bill payments made using its technology.

Synchrony Bank specializes in retail credit cards. It also offers a variety of consumer financial products, including money market accounts, IRA CDs, and medical and travel rewards cards. It also offers branded credit cards, including ones from many automakers. But before you choose to use Synchrony bank for your camping trip, be sure to weigh the advantages and disadvantages. A Synchrony credit card can help you build your credit history.

Co-branded Visa card

If you are a fan of the outdoors, you might want to consider applying for a Co-branded Visa card. These cards are issued by a partner – typically a large retailer – and can even be used for special interest groups such as the Sierra Club. The issuer of the card is the bank that issues the card, and it has final say on things like the credit limit and interest rate. The issuer also writes off bad debt.

The best co-branded credit cards are those that earn at least two points per dollar, and can also earn big sign-up bonuses. They should give you the ability to redeem rewards easily and quickly, and many offer generous sign-up bonuses. In addition to earning rewards, some offer other benefits. While some people choose to use these cards just before a trip to stock up on points, others will simply open them to maximize the sign-up bonus.

Those who love outdoor sports will appreciate the co-branded Costco Anywhere Visa. The card’s generous cash-back categories can rival those of the best rewards credit cards. And the bonuses can be redeemed for cash or credit in Costco stores. But if you don’t like to spend money on the outdoors, consider a regular rewards card instead. You’ll be able to earn points for all sorts of activities, from going on a hike to buying a new pair of shoes.

A co-branded card can also offer benefits for those who enjoy shopping in a particular brand. For example, if you love to go to the same clothing store every day, it might be worth looking into. Besides, co-branded cards come with special offers, such as discounts and special deals. However, you should be aware of the terms and conditions of the card and how you can use your card to earn them.

Reward program

Credit cards with reward programs for outdoor activities may be better for outdoor adventures than those that focus on city life. Credit cards with outdoor activities rewards focus on perks and can be worth their weight in gold when you use them for a variety of activities. However, credit cards aren’t worth their salt if you’re paying late fees or interest. Pay off your balance each month and make payments on time to maximize your rewards. And, of course, always spend only what you can afford.

Costco cash back

While there are many benefits to owning a Costco credit card, the annual fee can put some people off. However, the benefits are worth it. The Costco Visa credit card is one of the most popular, and is a popular choice among outdoor enthusiasts. This credit card offers unlimited three percent cash back on purchases at restaurants, concerts, theaters, groceries, and streaming services. You’ll also earn one percent cash back on all other purchases.

The Costco Anywhere Visa is a great option for frequent visitors of the company. You can earn a flat 1% cash back with this card, which is transferable to Costco stores or electronic transfers. Costco credit card cash back does have some restrictions. Redeeming your rewards is only possible once per year. Luckily, the annual certificate can be redeemed once a year for an extra three percent cash back.

I enjoyed a solo hike, it cleared my mind and was refreshing. I wore jeans, light jacket, and a hat.

I

If you’re a Costco shopper, you might wanna check out the Costco Anywhere Visa! This card is a real gem—no foreign transaction fees and no annual fee, plus it’s accepted anywhere Visa is. You can even use the Costco Anywhere Visa as a business card to really maximize those membership benefits. It’s a solid option for business owners, too, since you can earn cash back on your business purchases while you’re out and about.

Now, keep in mind that there are some restrictions on how much you can earn with the card, so it’s good to know the limits.

One of the best perks of the Costco Cash Rewards card is that it gives you a whopping 4% cash back on gas purchases. Since the average U.S. driver spends around $1,500 a year on gasoline, that extra $60 cash back can easily cover your annual Costco membership fee. It’s easy to see why the Costco Cash Rewards program has built up such a loyal following, especially among outdoor enthusiasts who are always on the go! So, if you’re lookin’ to save some bucks while fillin’ up your tank and snaggin’ great deals at Costco, this card’s definitely worth considerin’!

Cabelas Club Classic

The Cabela’s Club Classic credit card is just what an outdoor enthusiast like me needs! It’s got no annual fee, and those rewards points? They never expire, which is a big ol’ win in my book. The rewards program is super simple to use, too. I can earn points on every purchase, and I get access to some exclusive offers. Plus, there are some sweet perks, like exclusive shopping and behind-the-scenes access to outdoor companies. For a lot of folks, this card is a fantastic choice for their favorite pastime!

Now, if you’re lookin’ for somethin’ with a bit more kick, the Cabela’s CLUB Mastercard also comes with no annual fee and throws in a bonus of $30 CLUB points when you get approved. While that bonus might not be the biggest fish in the pond, it offers quick rewards and a low annual rate. And get this—it gives me a 2% cash-back bonus on purchases made at Bass Pro Shops and Cabela’s. With this card, I can dive into outdoor adventures like never before!

The Cabela’s CLUB card has some mighty fine benefits too. With no annual fee, I’m earnin’ a 2% cash-back rate on all my purchases at Bass Pro and Cabela’s. On top of that, cardholders earn CLUB points that can be redeemed for discounts and merchandise anywhere. The Cabela’s Club Classic card has different reward tiers, so Bass Pro Classic Tier cardholders earn 2% back on purchases, while the Silver and Black tiers can earn 3% and 5% back on all purchases. The benefits of this credit card are plenty, makin’ it a solid choice for anyone who loves the great outdoors! Yeehaw!

Dick Sporting Goods

If I’m fixin’ to take a weekend trip to Dick’s Sporting Goods, I’m happy to know I can pay for all my goodies with a credit card now. All I gotta do is register for an online account, and I can use my card to make payments. I’ll need my account number and ZIP code to get started, along with a User ID and password, plus my banking info. Once I’ve got that all set up, I can dive right into some serious shopping!

Now, let me tell ya about the Dick’s Sporting Goods credit card—it’s a real winner! I earn one point for every dollar I spend, whether I’m in the store or shoppin’ online. Plus, this card is linked to the Dick’s Move program, which offers even more perks and free services. I can take advantage of bike assembly, golf club fittings, and baseball glove steaming, and if I’ve got a Dicks card, I get free service for bowling ball drilling. How cool is that?

I can also shop by sport, with a whole bunch of equipment to choose from, like tennis rackets and free weights. And if I need some expert advice, they’ve got me covered! Plus, if I’m lookin’ to spread out the payment on my outdoor gear, I can take advantage of layaway options. And don’t forget, when I shop online with the Dick’s Sporting Goods credit card, I’ll enjoy free shipping!

LL Bean Mastercard

The L.L. Bean Mastercard is a credit card designed to reward loyal customers with rewards for their purchases. There is no annual fee, and many benefits include free shipping, return shipping, and exclusive sales. In addition, you’ll enjoy 15 percent off your purchases. This card is perfect for people who like to spend a lot of money at L.L. Bean.

One of the best things about this card is the rewards program. The rewards are redeemable only in the L.L. Bean stores. There’s no minimum redemption requirement and the points never expire. You can redeem them in any amount you choose, and any unused points will carry over to the next statement. You can redeem your rewards in store, over the phone, or online. The benefits of this card make it worth considering for people who love to shop at L.L. Bean.

If you are an outdoor enthusiast, the L.L. Bean Mastercard is a good option. It’s low-maintenance, has no annual fee, and rewards members with Bean Bucks for every purchase. Bean Bucks are equivalent to $1 and can be used for purchases in L.L. Bean stores or in a rewards program with other retailers. And because you’ll earn Bean Bucks on every purchase, you’ll have more money to spend on other outdoor gear.

Orvis Rewards

If you’re looking for ways to save money on your next outdoor purchase, the Orvis rewards credit card is worth looking into. The rewards program can help you get free gear, including discounted prices. You can also find exclusive offers on Coupofy and the company’s email newsletter. You can also check the company’s social media accounts to find out more about current promotions. But if you’re already a member, sign up for a newsletter to receive special discounts.

Once you’ve earned points through your Orvis credit card, you can redeem them in a variety of ways. You can use them to pay for products at Orvis, get free shipping on your order, or purchase items from select retailers. If you have an Orvis Rewards Visa card, you can get free standard shipping on orders over $25 and earn rewards points. Paypal lets you pay with your PayPal balance, linked cards, bank account, and other credit cards.

You can use your Orvis gift card both online and in-store. To use the card online, simply find the “Pay with Gift Card” section of your basket or check-out page. Then, enter your gift card number and 4-digit pin number in the appropriate fields. Orvis will then automatically apply the credit card reward points. The card is good for any outdoor purchase made at Orvis, and you can even use it to purchase gear, too.

REI World Elite

The REI World Elite Credit Card offers a variety of rewards for outdoor enthusiasts. It offers 5% cash back on purchases and a 1% rebate on other purchases, irrespective of channel. The card offers additional perks, too. A 10% member dividend is distributed annually in March. It accepts all major credit and debit cards, including Apple Pay and Android Pay. With this card, you can enjoy discounts, exclusive deals, and other rewards, including an annual membership to REI’s world headquarters.

The REI Co-op World Elite Mastercard is accepted everywhere that accepts Mastercard. You can also withdraw cash anywhere in the world via any ATM. Applicants should have a U.S. bank account and have an active membership in a REI co-op. REI’s World Elite Mastercard requires a U.S. Bank account and requires the user to enroll in its online account. This account offers secure 24/7 access, and the card also comes with a mobile app.

The REI World Elite Mastercard also gives back to the REI Foundation. For every purchase you make with the card, REI will donate $0.10 to the REI Foundation, a 501(c)(3) private charity dedicated to restoring wild places and connecting underrepresented groups to nature. The REI Foundation also supports climate change efforts and programs that connect underrepresented groups to the great outdoors. However, please note that the benefit is temporary and may change in future years.

Academy Sports

If you’re looking to buy outdoor gear, consider using an Academy Sports with credit card. This credit card earns you five points for every dollar you spend at an Academy store. The rewards are mailed to you after you reach 2,500 points, but you can’t redeem them for gift cards. If you want flexible rewards, you might be better off with a cashback card from almost any bank. Here’s a closer look at the Academy Sports with credit card outdoors.

If you’re not satisfied with your purchase, you can return it to Academy Sports for a refund or an exchange. However, you’ll have to send the item back to the manufacturer if it’s defective. The policy also applies to apparel and sports equipment. If you’ve worn the item, you can get a refund or exchange if you’ve changed your mind. If you’ve gotten the wrong size, you can always return it to Academy Sports for a refund.

To apply for an Academy Sports + Outdoors credit card, you must be 18 years of age or older and have a valid photo ID and government-issued tax identification number. Applicants must also provide a street address, rural route, or APO/FPO address. If you’re applying for an account online, the application form will appear in a new window. After you submit the information, you’ll receive your card in seven to ten business days.

Good Sam Rewards

If you love to spend time outdoors, you might want to consider the Good Sam Rewards credit card. The Good Sam Visa credit card gives you three points per dollar spent at specific stores, gas stations, and private campgrounds. All other purchases get one point. Using this card has its benefits: there’s no annual fee and you can manage your account online. You can also use it to purchase gas and restaurant gift cards. You can also find out more about the credit card’s benefits on the Good Sam Rewards site.

The Good Sam Rewards Visa(r) Credit Card is issued by Comenity Capital Bank and is only available to members of the program. Its logos are registered trademarks of Visa U.S.A. Inc. You may use this card at any of the family’s locations. It reports your account activity to the credit bureaus. You can also pay your bill online. Besides making the payment online, you can also use EasyPay to pay your bills. You can also get a free email account with daily summaries of new mail.

While the Good Sam Rewards credit card doesn’t require a camping trip, the rewards are more valuable than on most other reward cards. For example, if you buy a tent and stay at an RV park, you’ll earn 5 points per dollar spent at campgrounds. However, if you purchase a plane ticket, you won’t earn as many points. If you travel frequently, you can use your card to make purchases at the Amway Center.

Travel insurance

While traveling abroad, you may be wondering whether your credit card company offers travel insurance for outdoor activities. While most credit cards do offer insurance, they usually do not cover a wide variety of activities. Luckily, many outdoor recreation organizations have policies that can help you out in an emergency. In some cases, these policies even offer refunds if you cancel a reservation. These types of insurance are usually not included in traditional travel insurance policies and can be quite expensive.

If you don’t want to purchase travel insurance separately, you can also use your credit card’s travel benefits. For example, Allianz Global Assistance offers travel accident benefits when you purchase an annual travel plan. This insurance will pay out for specific injuries, including loss of sight or death. It is important to read the fine print and make sure you have all the coverage you need before traveling. To find out what’s covered, call your credit card provider and check the details. You may be surprised at how much coverage your credit card offers!

A travel insurance plan may also cover your essentials, such as medication and other items you’ll need during your trip. If your luggage is delayed or lost, it can cover the cost of essential purchases like food. Additionally, some travel insurance plans include collision coverage for rental cars, which will pay for damaged or stolen rental vehicles. Other types of travel insurance will reimburse you if you get injured or sick on a common carrier. Whether or not your card offers these types of coverage depends on your card and the company that provides it.

While credit card travel insurance is similar to traditional travel insurance policies, the coverage differs from one card to another. Some credit cards include travel medical insurance while others only cover trip protection. While both types of travel insurance offer peace of mind and financial protection, it is important to understand the details of your plan and how they apply to your situation. You should also be aware that credit card travel insurance policies do not cover medical expenses unless the damage was caused by a covered accident.

Outdoor activities list

-

Hikin’ and Trekkin’: Let me tell ya, hikin’ and trekkin’ are some of the best ways to explore new landscapes and get back in touch with nature. There are trails for all skill levels, from easy strolls to tough treks that’ll have you out there for days, testin’ your endurance. Just make sure to wear good boots, pack plenty of water, and bring along some navigational tools like maps or a GPS. Some awesome spots to hike include the Appalachian Trail in the U.S., Camino de Santiago in Spain, and the Milford Track in New Zealand.

-

Campin’: Campin’ is a great way to dive headfirst into the great outdoors. You can pick from different types of campin’, like car campin’, backpackin’, or RV campin’. Don’t forget the essentials—like a tent, sleeping bag, camp stove, and cookin’ gear. Always camp in designated areas and be respectful of Mother Nature. Some fantastic campin’ spots are Yosemite National Park in the U.S., Banff National Park in Canada, and The Lake District in the UK.

-

Rock Climbin’ and Mountaineerin’: If you’re lookin’ for an adrenaline rush, rock climbin’ and mountaineerin’ are right up your alley! These activities need some serious strength, endurance, and skills. If you’re just startin’, hit up a climbing gym or get a pro guide. You’ll need gear like climbin’ shoes, a harness, a helmet, and ropes. Popular spots for climbin’ include Yosemite National Park in the U.S., the Dolomites in Italy, and Mount Everest in Nepal for the real pros.

-

Canoein’ and Kayakin’: Canoein’ and kayakin’ are perfect for explorin’ lakes, rivers, and coastlines. You’ll need some upper body strength and, in some cases, the ability to swim. Don’t forget safety gear like life vests and helmets. Famous paddlin’ spots include the Boundary Waters in Minnesota, the Dordogne River in France, and Milford Sound in New Zealand.

-

Mountain Bikin’: Mountain bikin’ is a thrillin’ and physically demandin’ adventure. Trails can range from easy flat paths to gnarly downhill runs. You gotta have the right gear, like a solid mountain bike, a helmet, and maybe some body armor if you’re ridin’ hard. Renowned spots for mountain bikin’ include Moab in Utah, Whistler in Canada, and Queenstown in New Zealand.

-

Wildlife Safari: A wildlife safari is a chance to see animals in their natural habitat. Safaris are usually linked to Africa, where you can catch a glimpse of the “big five”—elephants, lions, rhinos, leopards, and buffalos—from a vehicle or on foot. In other parts of the world, you might spot kangaroos in Australia, bears in North America, or tigers in India.

-

Fishin’: Fishin’ is a chill pastime that takes a bit of patience and skill. You can fish in rivers, lakes, or the sea, and each type requires different gear and techniques. Popular fishin’ spots include the rivers of Montana for fly fishin’, the Great Barrier Reef in Australia for deep-sea fishin’, and the Amazon River in South America for peacock bass.

-

Scuba Divin’ and Snorkelin’: Scuba divin’ and snorkelin’ let you peek into the vibrant underwater world. You’ll need gear like a mask, snorkel, fins, and for scuba, a dive tank and regulator. Always make sure you have the right training before you dive. Some famous dive spots include the Great Barrier Reef in Australia, the Red Sea in Egypt, and the Galapagos Islands in Ecuador.

-

Skiin’ and Snowboardin’: These winter sports are a blast, cruisin’ down snowy mountains and feelin’ that rush of speed. If you’re a newbie, I’d recommend takin’ a lesson, ‘cause both activities need some practice and you might take a few tumbles along the way. Essential gear includes skis or a snowboard, poles for skiers, boots, warm clothes, and safety gear like helmets. Popular ski and snowboard spots include Aspen in the U.S., the Alps in Europe, and Niseko in Japan.

-

Surfing: Catchin’ a wave on a surfboard is a thrillin’ experience, but it takes balance, strength, and some practice. Beginners should start with a lesson in calm, small-wave conditions. You’ll need a surfboard and maybe a wetsuit, dependin’ on the water temperature. Hot surfing spots include the Gold Coast in Australia, the North Shore in Hawaii, and Jeffreys Bay in South Africa.

-

Paraglidin’ and Hang Glidin’: These activities give you that incredible feelin’ of flight. You’ll need training and a good understanding of weather conditions to stay safe. Key gear includes a paraglider or hang glider, a harness, helmet, and often a reserve parachute. Famous spots for paraglidin’ and hang glidin’ include Interlaken in Switzerland, Oludeniz in Turkey, and Rio de Janeiro in Brazil.

-

White-water Raftin’: White-water raftin’ is an exciting group activity that involves navigatin’ rapids on a river. It takes teamwork and can range from easy to downright dangerous, dependin’ on the river and the rapids’ level. Essential gear includes a raft, paddles, helmets, and life jackets. Renowned white-water raftin’ locations include the Colorado River in the U.S., the Zambezi River in Zambia/Zimbabwe, and the Futaleufú River in Chile.

-

Trail Runnin’: Trail runnin’ combines the cardio workout of runnin’ with the beautiful scenery of hiking trails. You’ll want a good pair of trail runnin’ shoes, clothes that suit the weather, and maybe a hydration pack for those longer runs. Notable trail runnin’ spots include the trails of Mont Blanc in the French Alps, the Grand Canyon in the U.S., and the Table Mountain trails in South Africa.

-

Golfin’: And of course, we can’t forget about golfin’! Whether you’re hittin’ the links with friends or just enjoyin’ a peaceful day on the course, it’s a great way to unwind and have some fun in the sun.

My Monthly Budget for Outdoor Recreation

-

Gear and Equipment: $100

- Hikin’ Boots: $60 (Gotta invest in a good pair if I don’t have ‘em already. Can’t be out there trippin’ over rocks!)

- Campin’ Gear: $40 (Thinkin’ about snaggin’ a new sleeping bag or maybe a portable stove. I always keep an eye out for sales or second-hand treasures to save some bucks.)

-

Transportation: $50

- Gas: $40 (I’m guessin’ how many trips I’m takin’. If I’m headin’ to a national park about 100 miles away, I might burn through $20-$30 in gas.)

- Public Transport: $10 (If I’m catchin’ a ride to a local trail or park, this’ll cover that.)

-

Park Entrance Fees: $20

- National/State Park Pass: $15 (Might as well get an annual pass since I’m always hittin’ the trails.)

- Day Passes: $5 (For those random visits to parks that charge per entry—no biggie!)

-

Campin’ Fees: $30

- Campsite Reservation: $25 (Most campgrounds charge about $20-$30 a night, so I’ll plan on that.)

- Firewood: $5 (If I’m campin’, I’ll need to grab some firewood when I get there.)

-

Food and Drinks: $60

- Groceries for Outings: $40 (Packin’ snacks like trail mix and sandwiches for my adventures.)

- Dining Out: $20 (Might treat myself to a meal after a long day of hikin’ or campin’—gotta refuel!)

-

Outdoor Activities: $50

- Kayak Rental: $30 (Rentin’ a kayak for a day on the lake sounds like a blast!)

- Climbin’ Gym Entry: $20 (If I’m workin’ on my climbin’ skills indoors, this’ll cover it.)

-

Fitness Classes or Trainin’: $40

- Yoga Class: $15 (Lookin’ for a local studio that offers outdoor classes—good for the soul!)

- Climbin’ Lessons: $25 (Thinkin’ about takin’ a class to sharpen my skills for outdoor rock climbin’—gotta stay safe out there!)

-

Clothing and Apparel: $30

- Moisture-Wickin’ Shirt: $20 (Perfect for hikin’ or any outdoor activity—stay cool out there!)

- Socks: $10 (Investin’ in some quality hikin’ socks to keep my feet happy.)

-

Miscellaneous: $20

- Sunscreen: $10 (Gotta protect my skin while I’m out enjoyin’ the sunshine.)

- Water Bottle: $10 (A sturdy, reusable water bottle is a must for stayin’ hydrated.)

Total Monthly Budget: $400

Tips for Keepin’ My Budget in Check:

- Trackin’ My Spendin’: I use an app to keep tabs on what I’m spendin’ each month. Helps me see where I might need to cut back.

- Plan Ahead: If I know I got a big trip comin’ up, I’ll save a bit more in the months leadin’ up to it.

- Lookin’ for Discounts: I always check for deals on gear, park passes, or activities. Places like REI or local outdoor shops have sales, especially in the off-season.

- Joinin’ Clubs or Groups: Sometimes, outdoor clubs offer discounts on gear rentals or classes, which can save me some cash while I’m enjoyin’ the great outdoors.

FAQ

Q: Can I use a credit card to purchase outdoor adventures? A: Absolutely! With the right credit card, you can finance your wild adventures, whether it’s skydiving, bungee jumping, or even climbing Mount Everest (just kidding, you might need some serious savings for that one!).

Q: Are there credit cards that offer emergency assistance for outdoor mishaps? A: While credit cards won’t send a helicopter to rescue you from a deserted island, some do provide emergency assistance services like roadside assistance, lost luggage coverage, or travel insurance, which can come in handy during outdoor escapades gone wrong.

Some are more difficult to obtain.

Good post. I buy sporting goods all the time. I am into hiking, climbing, running, biking, and fishing. I use the card that I have with me. Usually a visa. Most of mine offer 1.5 percent cashback. I am not seeing much difference.

Rotating categories is annoying, and so is filling out rebate vouchers.

Card charge 2p then give us 1.5p. Why not just charge .5p?

You made some good points. I am a frequent flyer on the water, doing kayaking, and swimming. I spnd 200 per month on hobbies, mostly outdoor. The REI store is awesome, they have everything. I browse, but do not buy, then go online and get cheaper from AMZ.

Cheers.

I rode Alaska airlines on my trip. It was alot like AA. Can you bring fishing poles and kayaks on a plane? I doubt it. I did not even ask. I rent upon arrival. It is good enough.

I have seen people carry on fishing poles. The flight attendants put them in the full size storage at front of cabin. You have to take them apart and wrap in plastic and tell them what it is.

I like to go kayaking. I use a card to purchase all my equipment mainly because I do not like to carry cash. You can get 1.5 percent back, but that does not amount to much. I also like to go running. I buy a new pair of shoes every year. I shop and order online more than going to the stores, since I know my size. I bring my wallet and cell phone in a plastic bag.

I like the Chase Freedom Flex and Capital One Venture Rewards. I have both.

I appreciate that there’s no annual fee, making it accessible for more people. It’s a win-win for outdoor enthusiasts who want to save while enjoying their adventures.

The store girl is cute.

I just use my regular amex for most things. I see no need for store cards.

You’re absolutely right—outdoor retailers often have some of the most visually appealing card designs. I’m curious. Have you used the Bass Pro Shops card for any specific purchases or experiences?